Welcome to CommerceNinja’s solutions for TS Grewal’s Class 12 Retirement of a Partner For the session 2024-25.

Our expertly crafted notes break down complex retirement of a partner class 12 ts grewal solutions into clear, manageable steps, ensuring you grasp both preparation and interpretation.

Designed to align perfectly with your curriculum, these solutions are ideal for exam preparation and enhancing your understanding of accounting.

Explore our detailed explanations and annotations to master the retirement of a partner class 12 ts grewal solutions and boost your confidence in this essential area of accounting. Happy studying!

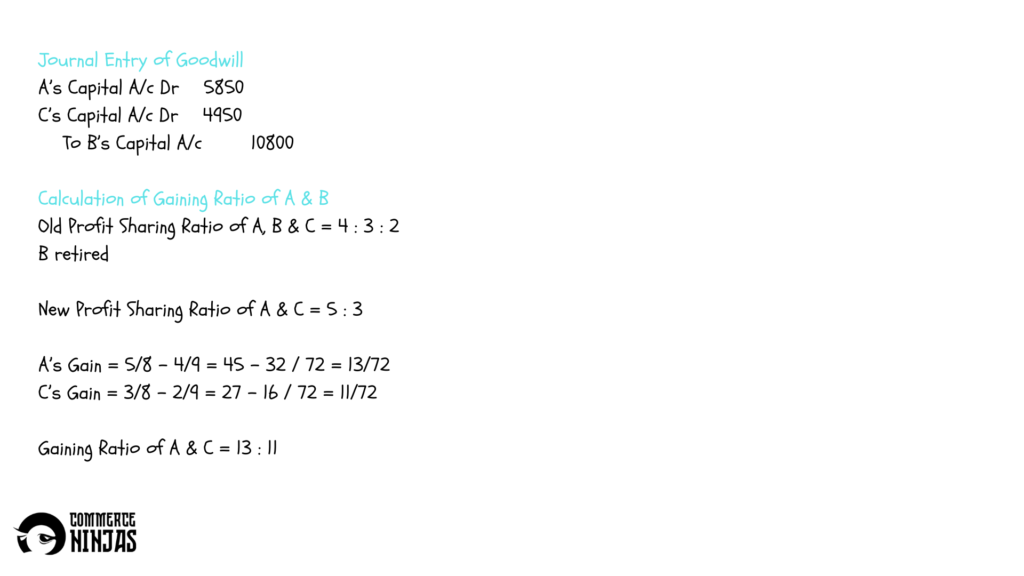

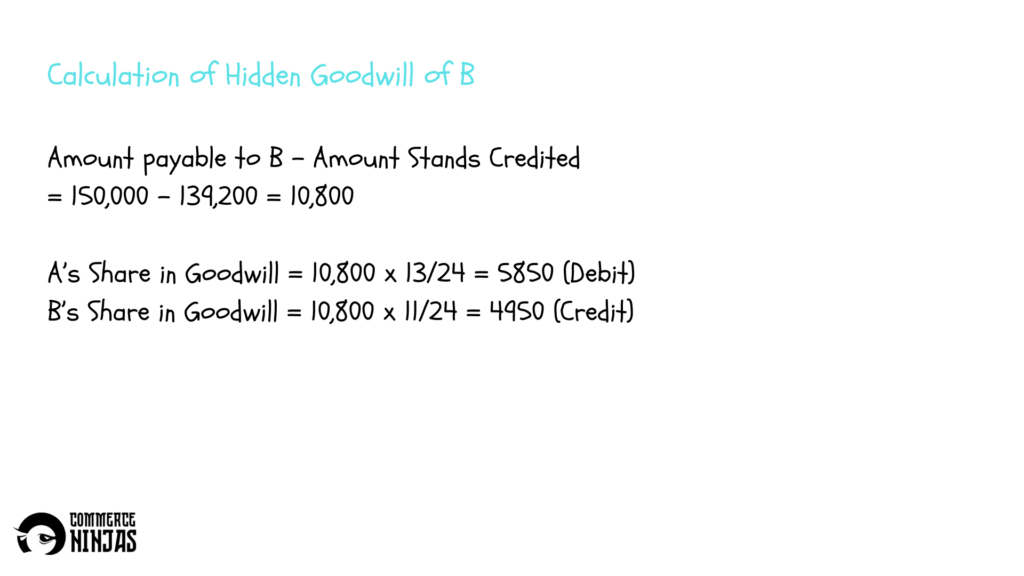

Q17. A, B and C are partners sharing profits in the ratio of 4/9 : 3/9 : 2/9. B retires and his capital after making adjustments for reserves and gain (profit) on revaluation stands at ₹ 1,39,200. A and C agreed to pay him ₹ 1,50,000 in full settlement of his claim. Record necessary Journal entry for adjustment of goodwill if the new profit sharing ratio is decided at 5 : 3.

SOLUTION:

How CommerceNinjas Can Help You Score 90%+ In Commerce?

At CommerceNinjas we are dedicated to making the best and most student friendly content in the field of 11th and 12th Commerce. We provide lectures, notes, cheatsheets, planners and a lot of other resources to help you ace your CBSE Commerce.

Check out our YouTube channel for free lectures and content and our Instagram page for kuch zyada funny memes.

Chalo ab padhlo 😉