This chapter is a part of the UNIT Accounting For Share Capital for class 12 according to the CBSE curriculum.

Table of Contents

Meaning of a Company

A company is an incorporated association which is an artificial person created by law, having a separate legal entity, with a perpetual succession and a common seal.

According to Section 2(20) of the Companies Act, 2013, “Company means a company incorporated under this act or any previous company laws”.

According to Chief Justice Marshall, “A company is a person, artificial, invisible, intangible and existing only in the eyes of law. Being a mere creation of law, its possesses only those properties which the charter of its creation confers upon it, either expressly or as incidental to its very existence.”

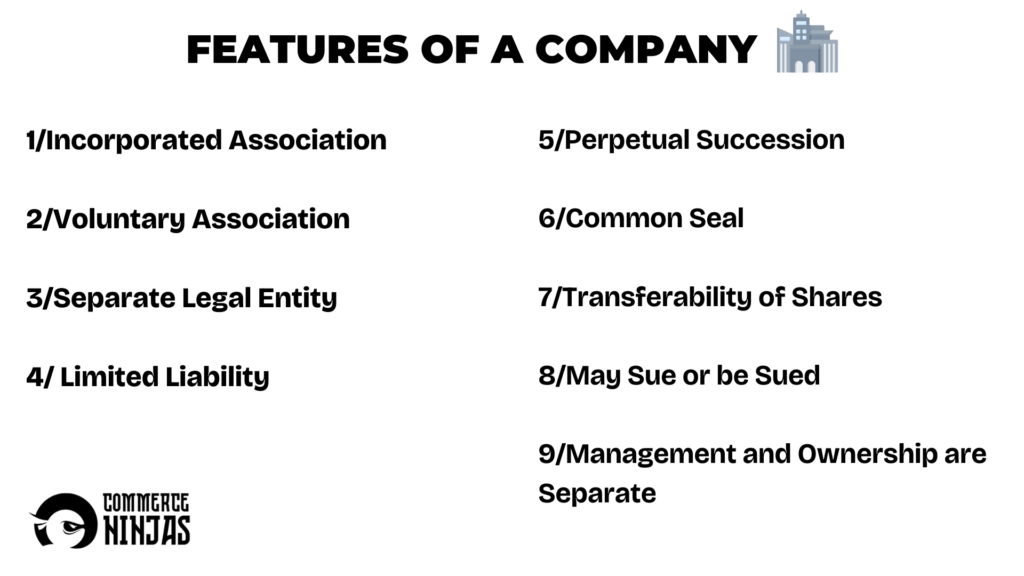

Feature of a Company

A company has certain special features which distinguish it from the other forms of organisation. These are as follows:

1/Incorporated Association: A company is an artificial person which comes into existence through the process of law, i.e. after being registered under the companies act, 2013.

2/Voluntary Association: Person who are willing to carry on a business, come together voluntarily to form a company.

3/Separate Legal Entity: A company has a separate legal entity distinct from that of its members who have formed it. Thus, it can enter into contract, own property, conduct business, sue or be sued.

4/Limited Liability: Liability of the members of a company is limited to the amount outstanding on the shares subscribed by each of them.

e.g. If a share of ₹100, a shareholder has paid ₹60, then he will be liable to pay only ₹40.

5/Perpetual Succession: Since company has a separate legal entity distinct from its shareholders, therefore it is not affected by death, lunacy or bankruptcy of its members or shareholders.

6/Common Seal: Company being an artificial person cannot sign the documents. So for this, a company is provided with a legal tool, called common seal. The common seal is affixed on all legal documents and is bonafide treated as the sign of the company.

7/Transferability Shares: Shares of a company are freely transferable, without restriction in the case of public companies and with restriction in case of private companies.

8/May sue or be sued: A company being a legal person can sue or be sued, if there is a breach of contract.

9/Management and Ownership are Separate: A company is not managed by all the members but by their elected representatives called directors.

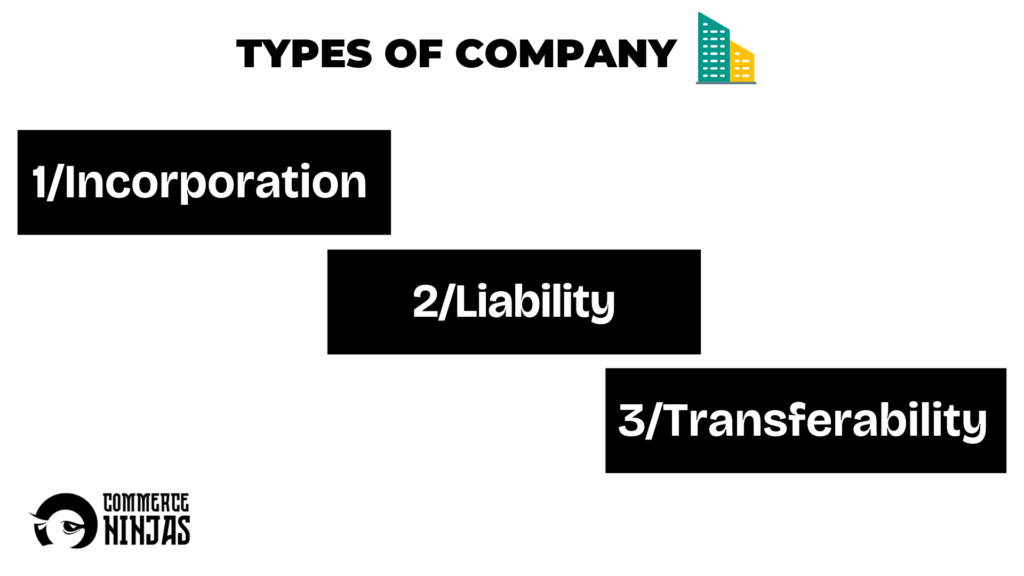

Classification / Types of Companies

1/Incorporation

It refers to the mode of formation of a company

The different categories of companies under this form are

(i) Chartered Companies: These companies are formed by special charter by the king or a sovereign. e.g. East India Company

(ii) Statutory Companies: These companies are formed by the special acts of the legislatures e.g. RBI.

(iii) Registered Companies: These companies are formed by registering under the Companies Act, 2013 or any other previous applicable acts e.g. Reliance Company, Tata Motors, etc.

2/Liability

It refers to the personal liability of members to pay for the debts incurred by the company.

The different categories of companies under this form are:

(1) Limited Liability Company or Company Limited by Shares

According to Section 2(22) of the Companies Act, 2013, a company having the liability of its members limited by the memorandum to the amount, if any, unpaid on shares respectively held by them is termed as a company limited by shares.

(2) Unlimited Liability Of A Company

According to section 2 (92) of the Companies Act, 2013, it is a company where the liability of its members is unlimited. It means, in the event of winding up, the debts of the company shall be met from the private property of the members.

(3) Company Limited by Guarantee

According to Section 2(21) of the Companies Act, 2013, it is a company having the liability of its members limited by the memorandum to such amount as the members may respectively undertake to contribute to the assets of the company in the event of it being wound up.

3/Transferability of Shares

It refers to the right of the members to transfer the shares held by them. The different categories of companies under this form are:

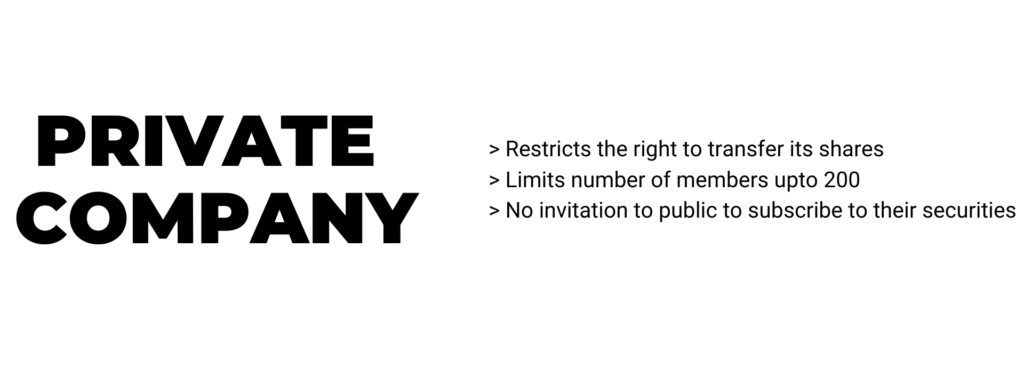

(i) Private Company: As per Section 2 (68) of Companies Act, 2013, a private company is one which has a minimum paid-up capital as maybe prescribed and which by its articles of association.

- Restricts the right to transfer its shares, if any.

- Except in one person company, limits the number of its members excluding its present and past employee members to 200.

- Prohibits any invitation to the public to subscribe for any securities of the company.

The name of a private company ends with the words, ‘Private Limited’.

(ii) Public Company: As per Section 2(71) of Companies Act, 2013, public company is a company which

- is not a private

- has minimum capital as may be prescribed

- is a private company, being a subsidiary of a company which is not a private company.

The name of the public company ends with the word ‘Limited’.

(iii) One Person Company: Section 2 (62) of the Companies Act, 2013 defines one person company as a company which has only one person as a member. It is a company incorporated as a private company which has only one member.

Incorporation of a Company

The Procedure for incorporating a company may be divided into following stages:

Stage 1: Promotion

In this stage, a person or a group of persons called promoters conceive an idea of a business and agree to form a company for such a business.

Stage 2: Incorporation or Registration

A company is incorporated, following the procedure prescribed in the Companies Act, 2013. The promoters after getting the name of the proposed company approved from the registrar of companies, submit various documents.

The documents are Memorandum of Association, Articles of Association, Consent of first director to act as directors and a declaration that the requirements of the companies act, 2013 have been compiled.

The registrar of companies, thereafter, issues certificate of incorporation, if he is satisfied the requirements of the companies act have been compiled with, The company there after companies act have been compiled with. The company thereafter comes into existence.

Stage 3: Capital Subscription and Commencement of Business

A company cannot commence its business unless

- A declaration is filed, with the registrar of companies by a director to the effect that

(a) Every subscriber to the memorandum has paid the value of the shares agreed to be taken by him.

(b) On the date of declaration , the paid-up share capital of the company is not less than as prescribed.

- A verification of its registered office is filed with the registrar, by the company.