This chapter is a part of the UNIT Accounting For Share Capital for class 12 according to the CBSE curriculum.

According to Section 2 (84) of the Companies Act, 2013, “Share means a share in the capital of a company and includes stock.” The capital of a company is divided into small units.

Each of these small units is called a share.

Shares give their holders a right of ownership, voting rights and right to share profits of a company.

It represents the shareholders’ interest in the company in the form of a contractual agreement.

Farewell J defines a share as, “Share is the interest of a shareholder in a company measured by a sum of money, for the purpose of liability in the first place and of interest in the second, but also consisting a series of mutual convenants entered into by all the shareholder’s interest.”

Each share has a nominal value or face value, which may be ₹1 or ₹2 or ₹5 or ₹10 or any amount and are numbered so that they may be identified. e.g. if the total capital of the company is ₹10,00,000 divided into 1,00,000 units of ₹10 each, then each unit of ₹10 will be called a share.

Thus, in the above case, the company has 1,00,000 shares of ₹10 each.

Nature of Shares

As per Section 44 of the Companies Act 2013, shares or debentures or other interest of any member in a company shall be movable property, transferable in the manner provided by the articles of the company.

According to the Sale of Goods Act, 1930, “Goods mean any kind of movable property other than actionable claims and money and includes stocks and shares”.

So, on the basis of above two definitions, it can be concluded that shares are basically goods which can be bought, sold or gifted.

Classes or Kinds of Shares

According to Section 43 of the Companies Act, 2013, shares are mainly classified into two categories.

- Preference Shares

- Equity Shares

Preference Shares

Preference Shares are the shares that carry the following two rights:

- A right to receive dividend at a stipulated rate or a fixed amount before any dividend is paid on equity shares

- Return of Capital on the winding-up of the company before that of equity shares.

Preference shares are classified into four categories.

On the basis of Payment of Dividend

(i) Cumulative Preference Shares : These are those shares which carry the right to receive arrears of dividend before dividend is paid to the equity shareholders.

(ii) Non-Cumulative Preference Shares: These are those shares which do not carry the right to receive arrears of dividend.

On the Basis of Convertibility

(i) Convertible Preference Shares: These shares give the right to the holder to get them converted into equity shares, at their option, according to the terms and conditions of their issue.

(ii) Non-Convertible Preference Shares: When the holder of a preference share does not have the right to get his holding converted into equity shares, it is called non-convertible preference shares. Preference shares are non-convertible unless otherwise stated.

On the Basis of Redemption

(i) Redeemable Preference Shares : When shares are repaid after some specified time in accordance with the terms of issue, they are called redeemable preference shares. In India, companies can issue redeemable preference shares with a maturity period of maximum 20 years only.

(ii) Irredeemable Preference Shares: These are those preference shares, the amount of which can be returned by the company to the holders of such shares at the time of its wound-up only. The Companies Act, 2013 does not permit issue of irredeemable preference shares.

On the Basis of Participation in Profits

(i) Participating Preference Shares: When a preference shareholder enjoys the right to participate in the surplus profit (in addition to the fixed rate of dividend) that is left after the payment of dividend to the equity shareholders, then this type of shares held by the shareholders is known as participating preference shares.

(ii) Non-Participating Preference Shares: When a preference shareholder receives only a fixed rate of dividend every year and does not enjoy the additional right to participate in the surplus profit, then this type of shares held by the shareholders is known as non-participating preference shares.

Equity Shares

Equity Shares are shares which are not preference shares. Thus, this share does not carry any preferential right. In other words, equity shares is one which entitled to dividend and repayment of capital after the claim of preference shares is satisfied.

1/Equity Shares with Voting Rights: These shares give their holders the right to vote on matters of corporate policy making, as well as, matters related to composition of the members of the board of directors.

2/Equity Shares with Differential Rights: These shares confer upon its holders differential rights as to dividend, voting or otherwise. Rule 4 of the Companies (share capital and debentures) Rules, 2014 deals with equity shares with differential rights.

| Basis | Preference Shares | Equity Shares |

| Dividend Rate | Preference Shares are paid dividend at a fixed rate | The rate of dividend on equity shares vary from year to year and depending upon the availability of profits. |

| Arrears of Dividend | If Dividend is not paid on these shares in any year, the arrears of dividend may accumulate (in case of cumulative preference shares) | In case of equity shares, no such recoupment is possible. |

| Redemption | Preference Shares can be redeemed as provided by the articles and terms of issue | Equity shares cannot be redeemed except under a scheme involving reduction of capital |

| Payment of Dividend | These shares have preferential right to receive dividend before any | Payment of dividend on equity shares is made only after dividend has been paid to preference shareholders. |

| Payment of Capital | In the event of winding up, preference shareholders have a preferential right to receive capital, before capital or any amount thereof is returned to equity share holders. | Equity Share Capital is paid only after full payment is made to preference shareholders. |

| Voting Rights | Preference Shareholders do not have any voting right except when their interest is directly affected. | Equity shareholders enjoy voting rights. |

| Participation in Management | Preference shareholders do not have the right to participate in the management of the company. | Equity Shareholders have full right to participate in the management of the company. |

| Trading on Equity | Preference Shares help the owners to derive the benefit of trading on equity | Availability of only equity share capital in the total capital of a concern involves high degree of risk and an element of uncertainity. |

| Company’s Formation | A company with only preference shares cannot be formed. | A company may be formed only with equity shares. |

Share Capital

A company, being an artificial person, cannot generate its own capital rather it is necessarily to be collected from several persons. These persons are known as shareholders and the amount contributed by them is called share capital.

Share Capital is the amount that a company can raise or has raised by issue of shares. It is that part of the capital of a company, which is represented by the total nominal value of shares it has issued.

From accounting point of view, share capital can be classified as:

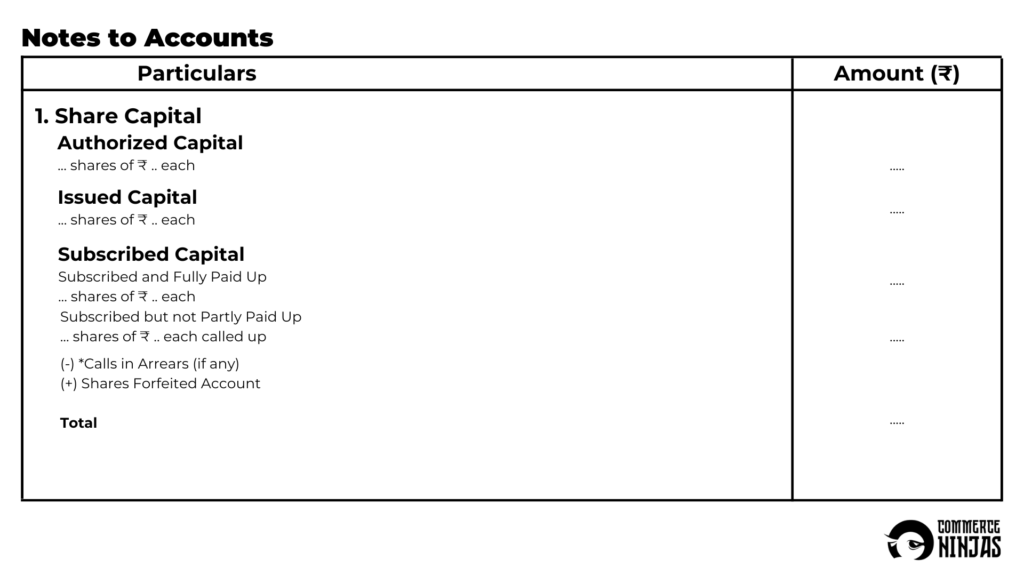

Authorized Share Capital

According to Section 2(8) of Companies Act, 2013, ‘Authorized Capital’ or ‘nominal capital’ means such capital as is authorized by the memorandum of a company to be the maximum amount of share capital of the company.

It is the maximum amount of share capital which a company is authorized by its memorandum of association to issue to shareholders. In other words, the company cannot raise more than the amount of capital as specified in the memorandum of association. It is also called nominal or registered capital. The authorized share capital under each class (equity or preference) may be more or atmost equal to the issued share capital, but cannot be less than the issued share capital

Issued Capital

According to Section 2(50) of the Companies Act, 2013, issued capital means such capital as the company issues from time-to-time for subscription. It is that part of the authorized capital which is actually issued to the public for subscription.

It also includes the shares allotted for consideration other than cash, shares taken by directors as qualifying shares and the shares subscribed by the signatories to the company’s memorandum. Issued Share Capital cannot exceed the company’s authorized share capital.

Subscribed Capital

According to Section 2(86) of the Companies Act, 2013, subscribed capital means such part of the issued capital which has been subscribed by the members of a company. It also includes shares allotted for consideration other than cash, shares subscribed by the signatories to the company’s memorandum and shares taken by directors as qualifying shares. This capital can further be categorized as:

(i) Subscribed and Fully Paid-Up: Shares are said to be ‘subscribed and fully paid-up’ when the entire nominal (face) value is called and also paid up by the shareholders.

(ii) Subscribed but not Fully Paid-Up: Shares are said to be ‘subscribed but not fully paid up’ under the following situations when:

- Company has called-up the entire nominal (face) value of the share but it has not been received

- Company has not called-up full nominal (face) value of the share.

Called-up Capital

According to Section 2(15) of the Companies Act, 2013, ‘called up capital’ means such part of the capital, which has been called for payment. It means the amount of nominal (face) value called up by the company to be paid by the shareholders towards the share capital.

Paid-Up Capital

According to Section 2(64) of the Companies Act, 2013, ‘paid up share capital’ or ‘share capital paid up’ means such aggregate of money credited and paid-up as is equivalent to the amount received as paid-up, in respect of shares issued.

It also includes any amount credited as paid-up in respect of such shares of a company. It does not include any other amount received in respect of such shares, by whatever name called. It means the amount that the shareholder has paid and the company has received (against the amount ‘called up’) towards share capital.

Reserve Capital

It is that portion of subscribed share capital, remaining uncalled, which shall not be capable of being called-up except in the event and for the purpose of the company being wound-up.

Where a company has passed a resolution for reserve capital, these are are shown as ‘subscribed but not fully paid-up’.

However an unlimited company on becoming a company limited by shares, must have reserve capital.

Capital Reserve

It is mandatory to create capital reserve in case of capital profits earned by the company. These are the reserves which are created out of capital profits and are not readily available for distribution as dividend among the shareholders. e.g.: Premium on Issue of shares or debentures, profits on re-issue of shares, profits prior to incorporation, premium on redemption of debentures, etc.

Reserve Capital vs Capital Reserve

| Basis | Reserve Capital | Capital Reserve |

| Meaning | It refers to that portion of uncalled share capital which shall not be called-up except in the event of winding up. | It is that reserve which is created out of capital profits such as profit on sale of fixed assets, profit on revaluation of fixed assets etc. These profits are not earned in the normal course of business. |

| Creation | It is not necessary to create a Reserve Capital Fund. | It is necessary to create a Capital Reserve Fund. |

| With Respect to Amount | It refers to the amount which has not been received | It refers to the amount which has already been recieved |

| Disclosure | It is not shown in the company’s balance sheet | It is shown as the first item under the head, ‘Reserves and Surplus’ on the liabilities side of the balance sheet. |

| When it Can be Used? | It can be used only at the time of winding-up of the company | It can be used to write-off capital losses or to declare a bonus share any time during the life of a company. |

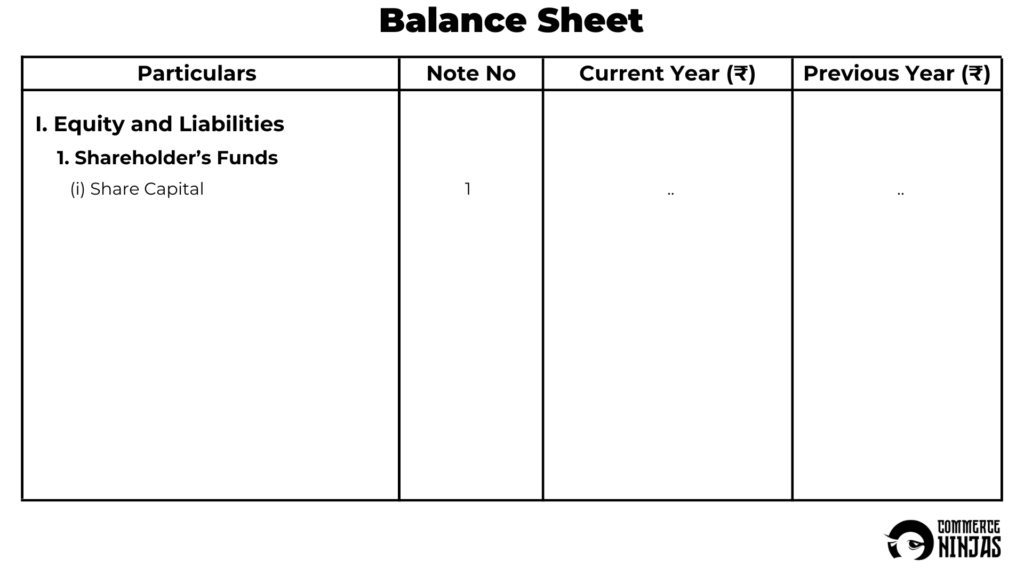

Disclosure of Share Capital in Company’s Balance Sheet