This chapter is a part of the UNIT Accounting For Share Capital for class 12 according to the CBSE curriculum.

Table of Contents

On the basis of applications received by the public, an issue may be fully subscribed, undersubscribed or oversubscribed.

Full Subscription of Shares

When the number of shares applied for is equal to the number of shares offered for subscription, the issue is said to be fully subscribed. e.g. GH Ltd. issued 25,000 equity shares of ₹10 each and received applications for 25,000 equity shares.

However, this is a very rare situation. In reality, shares are generally undersubscribed and oversubscribed.

Undersubscription of Shares

When the number of shares applied for is less than the number of shares offered for subscription, the issue is said to be undersubscribed. e.g. GH Ltd. issued 25,000 equity shares for ₹ 10 each and received applications for 22,000 shares.

EXAMPLE 1: Parth Ltd. was registered with a capital of ₹10,00,000 in shares of ₹20 each. It invited applications for 50,000 shares. The amount is payable as ₹5 on application, ₹10 on allotment and ₹5 on first and final call. Give journal entries for the above transactions when the public has subscribed for 46,500 shares.

SOLUTION:

PARTICULARS |

DEBIT |

CREDIT |

Share Application A/c Dr |

232,500 |

|

Share Allotment A/c Dr To Share Capital A/c (46,500 x 10) |

465,000 |

|

Share First and Final Call A/c Dr To Share Capital A/c |

232,500 |

|

EXAMPLE 2: The authorized capital of Suhani Ltd ₹45,00,000 divided into 30,000 shares of ₹150 each. Out of these, company issued 15,000 shares of ₹150 each at a premium of ₹10 per share. The amount was payable as follows:

₹ 50 per share on application, ₹40 per share on allotment (including premium), ₹30 per share on first call and balance on final call. Public applied for 14,000 shares. All the money was duly received. Pass journal entries.

SOLUTION:

PARTICULARS |

DEBIT |

CREDIT |

Bank A/c Dr (14,000 x 50) To Share Application A/c |

700,000 |

|

Share Application A/c Dr To Share Capital A/c |

700,000 |

|

Share Allotment A/c Dr To Share Capital A/c (14,000 x 30) To Securities Premium Reserve A/c (14,000 x 10) |

560,000 |

140,000 |

Bank A/c Dr To Share Allotment A/c |

560,000 |

|

Share First Call A/c Dr To Share Capital A/c (14,000 x 30) |

420,000 |

|

Bank A/c Dr To Share First Call A/c |

420,000 |

|

Share Second and Final Call A/c Dr To Share Capital A/c (14,000 x 40) |

560,000 |

|

Bank A/c Dr To Share Second and Final Call A/c |

560,000 |

|

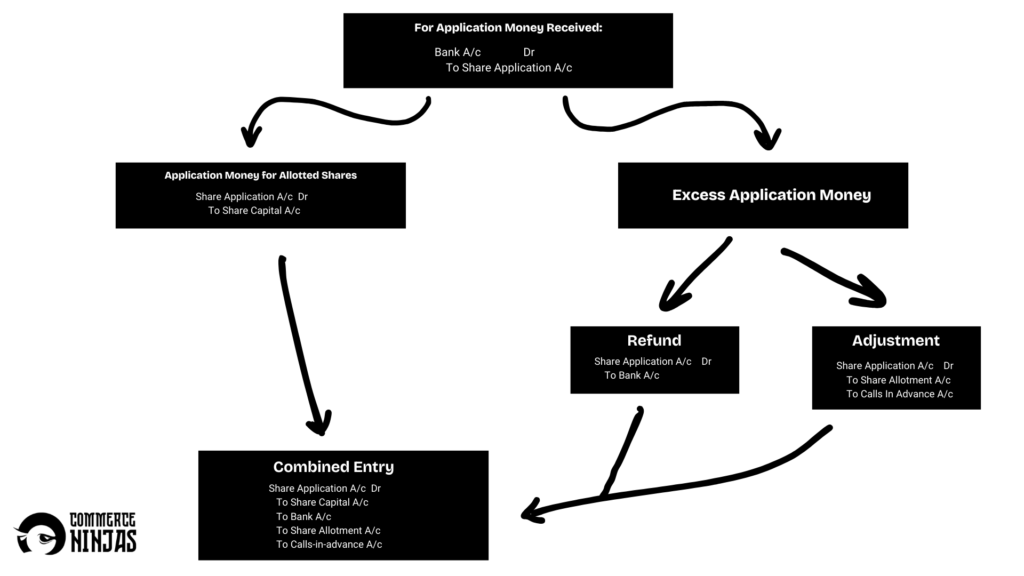

Oversubscription of Shares

When the number of shares applied for is more than the number of shares offered for subscriptions, the issue is said to be oversubscribed. e.g. GH Limited issued 25,000 equity shares of ₹ 10 each and received applications for 30,000 shares.

In case of oversubscription, following three alternatives are available

Rejection of Applications

Some applications are accepted in full and excess applications are rejected outrightly and their application money is refunded. This is known as rejection of applications. The application money received from rejected application is fully refunded.

e.g. applications are invited for 25,000 shares and applications are received for 35,000 shares. Applications for shares are in excess of 25,000 shares i.e. 10,000 shares are not accepted and their application money is refunded.

Partial or Pro-rata Allotment

In this case, no application for shares is refused and no applicant is allotted the shares in full. Smaller number of shares are allotted to each applicant according to the number of shares applied by him.

In this case, the excess application money received is normally adjusted towards the amount due on allotment.

In case, the excess money is more than the amount due on allotment of shares, the excess amount may either be refunded or credited to calls-in-advance account. e.g. applications are invited for 25,000 shares and applications are received for 35,000 shares. Shares are allotted to all the applicants in the ratio of 25 : 35 i.e. 5 : 7.

Combination of Pro-rata Allotment and Rejection

In this case, some applications are accepted in full, some applications are outrightly rejected and proportional allotment is made to remaining e.g. applicants are allotted shares as, applications for 10,000 shares are accepted in full, applications for 5,000 shares are rejected and the balance applications are allotted on pro-rata basis i.e. in the ratio of 3 shares for every 4 shares applied.

Accounting Entries in Case of Oversubscription

EXAMPLE 3: Janta Papers Ltd invited applications for 100,000 equity shares of ₹25 each payable as under:

On Application ₹5 per share

On Allotment ₹7.50 per share

On First Call ₹6 per share

On Second Call ₹6.5 per share

Applications were received for 400,000 shares on 1st January 2018 and allotment was made on 1st February, 2018. Record Journal Entries in the books of the company considering the directors totally rejected the application of 200,000 shares and accepted full applications for 80,000 shares and made a pro-rata allotment of 20,000 shares to the remaining applicants. The excess of application money is to be adjusted towards allotment and calls to be made.

SOLUTION:

Date |

Particulars |

Debit |

Credit |

2018 Jan 1 |

Bank A/c Dr (400,000 x 5) To Share Application A/c |

20,00,000 |

20,00,000 |

Feb 1 |

Equity Share Application A/c To Equity Share Capital A/c To Equity Share Allotment A/c To Calls in Advance A/c To Bank A/c (WN) |

20,00,000 |

150,000 250,000 11,00,000 |

Feb 1 |

Share Allotment A/c Dr To Share Capital A/c (100,000 x 7.5) |

750,000 |

|

Feb 1 |

Bank A/c Dr To Share Allotment A/c |

600,000 |

|

Apr 1 |

Share First Call A/c Dr To Share Capital A/c (100,000 x 6) |

600,000 |

|

Apr 1 |

Bank A/c Dr Calls In Advance A/c Dr To Share First Call A/c |

600,000 120,000 |

|

Jun 1 |

Share Second and Final Call A/c Dr To Share Capital A/c (100,000 x 6.5) |

650,000 |

|

Jun 1 |

Bank A/c Dr Calls In Advance A/c Dr To Share Second and Final Call A/c |

520,000 130,000 |

|

WORKING NOTE:

Excess Application Money 15,00,000

(-) Transfer

Share Allotment (20,000 shares @ ₹7.50) (150,000)

Share Calls (20,000 shares @ ₹12.50) (250,000)

Amount to be refunded (including that on the rejected applications) = 11,00,000