This topic is a part of the UNIT Fundamentals of Partnership Class 12 according to the CBSE curriculum.

Salary or commission to a partner is to be allowed only if the partnership agreement provides for the same.

Salary or commission to a partner is an appropriation out of profits and not a charge against the profits, i.e. they are to be allowed only if there are profits. So, they should be transferred to the debit of profit and loss appropriation account and not to the debit of profit and loss account.

If the amount of available profit is less than the amount of appropriations to be made, the available profits should be distributed in the ratio of appropriations to be made (i.e. no particular appropriation item has priority over another appropriation item).

Calculation of Commission Based on Profit

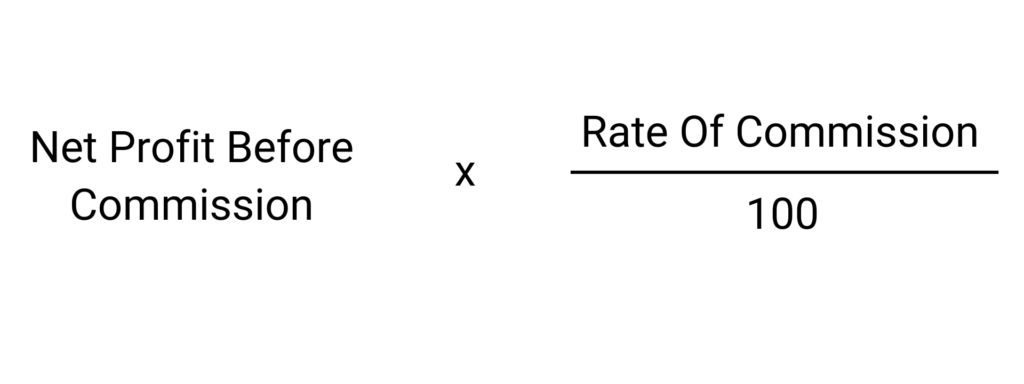

Commission may be allowed as percentage of net profit before charging such commission or after charging such commission.

Commission as a percentage of net profit before charging such commission

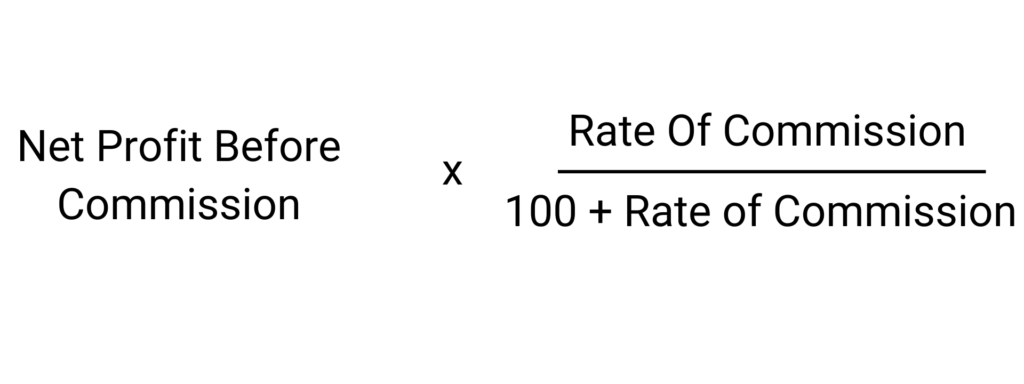

Commission as percentage of net profit after charging such commission

Q. Sonu and Rachit are partners in a firm. Sonu is to get a commission of 10% of net profit before charging any commission. Rachit is to get a commission of 10% of net profit after charging all commissions. Net profit before charging any commission was 55,000. Find out the commissions of Sonu and Rachit. Also, show the distribution of profit.

SOLUTION:

Sonu’s comission as a % of net profit before charging such commission

= Net profit before commission x Rate of commission / 100 = 55,000 x 10/100 = 5500

Rachit’s commission as % of net profit after charging such commission

= Net profit before commission x Rate of commission / 100 + Rate of Commission = (55,000 – 5500) x 10/110 = 49,500 x 10/110 = 4500.

Read more from Fundamentals of Partnership

Profit and Loss Appropriation Account

Salary or commission paid to a partner

Rent paid to partner and Interest on loan