This topic is a part of the UNIT Fundamentals of Partnership Class 12 according to the CBSE curriculum.

Table of Contents

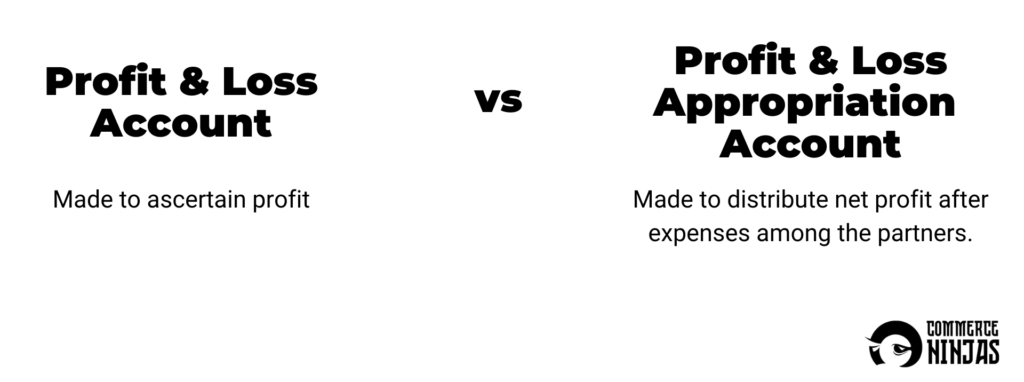

The profit and loss appropriation account is an extension of the profit and loss account. It is prepared to show distribution/appropriation of net profit among the partners (whereas profit and loss account is prepared to ascertain profit)

It should be kept in mind that profit and loss appropriation account records the appropriation of profits and not the charges against profit.

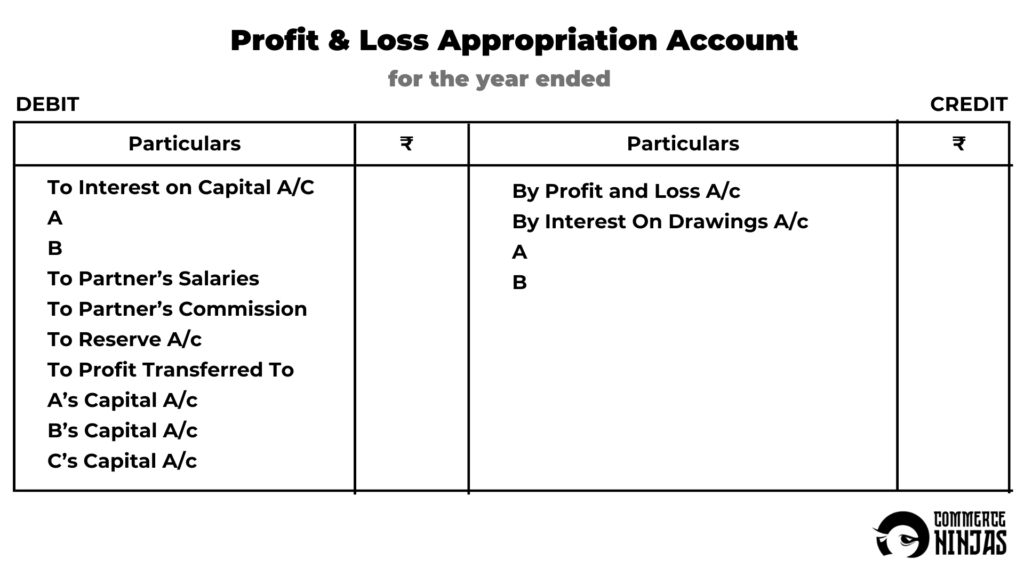

Profit and Loss Appropriation account is credited with net profit and interest on drawings of the partners, while debited with interest on capitals of the partners, partner’s salaries and commissions, etc.

Also, if partners want, an amount can be transferred to reserve account out of the net profits.

The balance of the net distributable profits is distributed between/among the partners according to their profit sharing ratio.

In case, profit and loss account shows net loss, it is not transferred to profit and loss appropriation account, instead a temporary account named as profit and loss adjustment account is opened to distribute net loss among the partners.

Format of Profit and Loss Appropriation Account

Journal Entries Relating to Items of Profit and Loss Appropriation Account

| ENTRY | |

| 1. Transfer of profit from profit and loss account to profit and loss appropriation account | Profit & Loss A/c Dr To Profit and Loss Appropriation A/c |

| 2. Transfer of loss from profit and loss account to profit and loss appropriation account | Profit and Loss Appropriation A/c To Profit and Loss A/c |

| 3. For allowing interest on capital | (i) Adjusting Entry Interest on Capital A/c To Partner’s Capital/Current A/c (individually) (ii) Closing Entry Profit and Loss Appropriation A/c To Interest on Capital A/c |

| 4. For partner’s salaries/commission | (i) Adjusting Entry Partner’s Salaries / Commission A/c To Partner’s Capital/Current A/c (ii) Closing Entry Profit and Loss Appropriation A/c To Partner’s Salaries/Commission A/c |

| 5. For charging interest on drawings | (i) Adjusting Entry Partner’s Capital A/c To Interest on Drawings (ii) Closing Entry Interest on Drawings A/c To Profit and Loss Appropriation A/c |

| 6. For transfer to reserve out of profits | Profit and Loss Appropriation A/c To Reserve A/c |

| 7. For transfer of credit balance of profit and loss appropriation account (being profit) | Profit and Loss Appropriation A/c To Partner’s Capital A/c |

| 8. For transfer of debit balance of profit and loss appropriation account | Partner’s Capital A/c To Profit and Loss Appropriation A/c |

Read more from Fundamentals of Partnership

Profit and Loss Appropriation Account

Salary or commission paid to a partner

Rent paid to partner and Interest on loan