This topic is a part of the UNIT Fundamentals of Partnership Class 12 according to the CBSE curriculum.

Table of Contents

If after closing the accounts of a partnership firm, some errors or omissions are discovered in the accounts, e.g. interest on capital or drawings may not have been allowed or charged, charged or allowed at a higher rate or lower rate, etc.

Then, such errors and omissions are rectified by making adjustments instead of altering the closed accounts in the next accounting period. Such adjustments are called Past Adjustments, as they relate to past period.

Accounting for Past Adjustments is made directly through the capital accounts of the concerned partners. Usually the following types of adjustments are effected:

- When Interest on Capitals may have been omitted by mistake or have been wrongly treated.

- When Interest on drawings may have been omitted

- When salary or commission payable to a partner has been omitted

- When profit sharing ratio has been changed with effect from some past date (i.e. retrospectively)

- When profits and losses have been distributed among the partners in the wrong ratio.

These errors or omissions can be rectified in two ways:

When a Single Adjustment entry is passed for Past Adjustments

In this case, a single adjusting entry is passed by debiting and crediting the partner’s capital/current account with the net effect (amount) of all the errors (past adjustments)

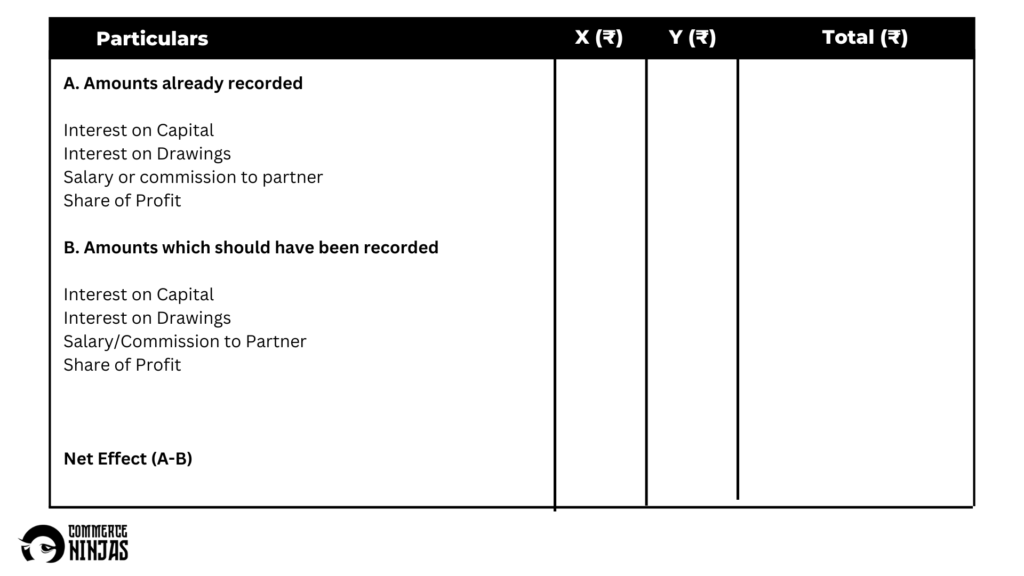

Steps to pass Adjusting Journal Entry

Step 1: Calculate the amount already recorded by the way of share of profit, interest on capital, salary, commission, etc.

Step 2: Calculate the amount which should have been recorded by the way of interest on capital, salary or commissions, or share of profit, etc.

Step 3: Calculate the difference between the amounts calculated as per Step 1 and the amount calculated as per Step 2.

Step 4: Find out the partner who received excess and the partner who received less

Step 5: Pass the adjusting journal entry by debiting the capital account of partner who received excess and by crediting the capital account of partner who received less.

Format of Adjustment Table

Let us look at an example to understand the concept better

Past Adjustment Example

A, B and C are partners. Their Capitals as on 1st April, 2018 were A 100,000, B 200,000 and C 300,000. Profits for the year 2017-18 amounted to 120,000 which was then distributed among the partners in the ratio of their capitals without providing for the following:

(i) Interest on capitals: A 10,000 B 20,000 C 10,000

(ii) Interest on Drawings: A 6000 B 10,000 C 16000

(iii) C was guaranteed a profit of 20,000 per annum

The partnership deed was silent as to the sharing of profits and losses. Pass the necessary single adjustment entry.

SOLUTION:

| Paritculars | A | B | C |

| Amount’s Already Recorded | |||

| Share of profit (120,000 in 1:2:3) | 20,000 | 40,000 | 60,000 |

| Amounts which should have been recorded | |||

| Interest on Capital | 10,000 | 20,000 | 10,000 |

| Interest on Drawings | (6000) | (10,000) | (16,000) |

| Salary (2000 x 12) | 24,000 | – | – |

| Commission | – | 8000 | – |

| Guarantee to C | – | – | 20,000 |

| Share of Profit (60,000 in 1:1:1) | 20,000 | 20,000 | 20,000 |

| Net Effect | 28,000 Credit | 2000 Debit | 26,000 Debit |

Revised Profits = 120,000 – 90,000 – 30,000 +6000 + 10,000 + 16,000 – 24,000 -8000 = 60,000

| Particulars | Amount (Debit) | Amount (Credit) |

| B’s Capital A/c C’s Capital A/c To A’s Capital A/c (Being rectification entry passed) | 2000 26,000 | 28,000 |

On 31st March 2019, the balance in the capital accounts of Abhir, Bobby and Vineet, after making adjustments for profits and drawings were 800,000, 600,000, and 400,000 respectively. Subsequently, it was discovered that interest on capital and interest on drawings had been omitted. The partners were entitled to interest on capital @10% per annum and were to be charged interest on drawings @6% per annum. The drawings during the year were: Abhir 20,000 drawn at the end of each month, Bobby 50,000 drawn at the beginning of every half year and Vineet 100,000 withdrawn on 31st October 2017. The net profit for the year ended 31st March, 2018 was 150,000. The profit sharing ratio was 2:2:1. Pass necessary adjusting entry for the above adjustments in the books of the firm. Also show your workings clearly.

Solution:

| Particulars | Debit | Credit |

| Bobby’s Capital A/c Dr To Abhi’s Capital A/c To Vineet’s Capital A/c | 14,402 | 10,112 4,290 |

Calculation of Opening Capital

| Particulars | Abhir | Bobby | Vineet |

| Capital at the end | 800,000 | 600,000 | 400,000 |

| (+) Drawings | 240,000 | 100,000 | 100,000 |

| (-) Profit | (60,000) | (60,000) | (30,000) |

| Capital at the beginning | 980,000 | 640,000 | 470,000 |

WORKING NOTES:

| Paritculars | Abhir | Bobby | Vineet | TOTAL |

| Amount to be debited | ||||

| Profit | 60,000 | 60,000 | 30,000 | 150,000 |

| Interest on Drawings | 6600 | 4500 | 2500 | 13600 |

| Amount to be Credited | ||||

| Interest on Capital | 76,712 | 50,098 | 36,790 | 163,600 |

| Interest on Capital will be allowed to the Extent of Maximum Profit Available | 10,112 Credit | 14,402 Credit | 4,290 Debit | NIL |

When Separate Adjustment Entry is passed for Past Adjustment

In this case, separate journal entries are passed in place of one single adjustment entry and analytical table is also not prepared to determine the net effect of all the adjustments. Instead, separate journal entries are passed for each error or omission by debiting or crediting the profit and loss adjustment account.

After all the adjustment entries are passed, profit and loss adjustment account is closed by debiting or crediting the partner’s capital/current accounts.

Separate Adjustment Entry Example

A, B and C are partners in a firm. Their capital accounts stood at 150000, 75000 and 75000 respectively on 1st April, 2020. As per provisions of the deed:

(i) C was to be allowed a remuneration of 18,000 per annum

(ii) Interest @ 5 % per annum was to be provided on capitals

(iii) Profits were to be distributed in the ratio of 2 : 2 : 1.

Ignoring the above terms, net profit of 90,000 for the year ended 31st March, 2020 was distributed among the three partners equally, Pass the journal entries to rectify the above errors.

SOLUTION:

| Particulars | Debit | Credit |

| A’s Capital A/c Dr B’s Capital A/c Dr C’s Capital A/c Dr To P&L Adjustment A/c | 30,000 30,000 30,000 | 90,000 |

| P&L Adjustment A/c Dr To C’s Capital A/c | 18,000 | 18,000 |

| P&L Adjustment A/c Dr To A’s Capital A/c To B’s Capital A/c To C’s Capital A/c | 15,000 | 7500 3750 3750 |

| P&L Adjustment A/c Dr To A’s Capital A/c To B’s Capital A/c To C’s Capital A/c | 57,000 | 22,800 22,800 11,400 |

Read more from Fundamentals of Partnership

Profit and Loss Appropriation Account

Salary or commission paid to a partner

Rent paid to partner and Interest on loan