This topic is a part of the UNIT Fundamentals of Partnership Class 12 according to the CBSE curriculum.

Interest on capital is generally allowed to compensate partners for contributing capital to the firm in excess of profit sharing ratio. This happens in the following conditions.

- When the capital contribution

- When the capital contribution is same but profit sharing is unequal

- When the capital contribution is unequal and profit sharing is also unequal

Interest on capital is credited to the partners capital account at the agreed rate with reference to the time period for which the capital remained in the business during a financial year.

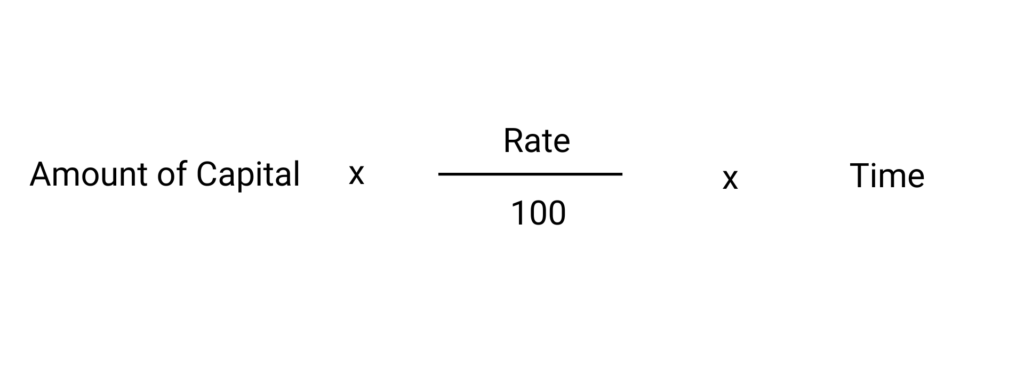

Formula:

In case additional capital is introduced by the partners, then interest on such capital is calculated for that part of the accounting period for which it remained in the business.

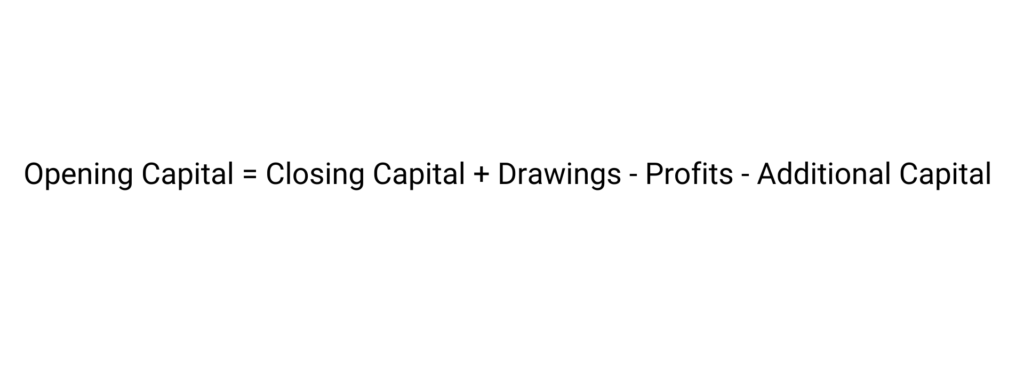

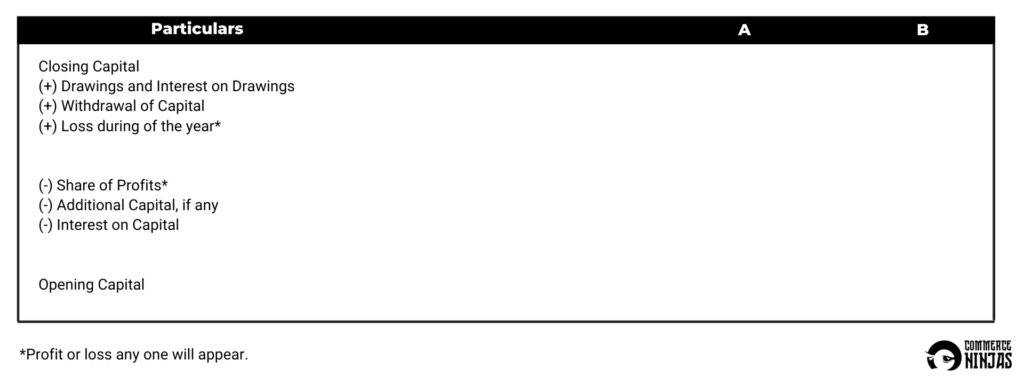

Interest on capital is always calculated on the opening balance of the capital in a a year. In case the question gives closing capital, then opening capital will be calculated first, by using the following formula.

The above equation can be put in the form of a table as below:

Different Cases Related to Interest on Capital

Case 1: When partnership agreement is silent as to interest on capital.

Treatment: Interest on capital is not allowed in this case.

Case 2: When partnership agreement says interest on capital is to be provided as a charge.

Treatment: Interest on capital is fully allowed to whether there is a profit or loss because charges are fully provided irrespective of the amount of profit & loss.

Case 3: When partnership agreement provides that interest on capital is to be allowed, but is silent as to the treatment of interest as charge or appropriation.

Treatment: Interest on capital will be allowed only if there are profits.

- Situation 1: In case of loss, no interest will be allowed

- Situation 2: In case there are sufficient profits, i.e. when profit before interest is equal to or more than the interest full interest on capital will be allowed.

- Situation 3: In case of insufficient profits, i.e. when profit before interest is less than the interest, profits will be distributed proportionately in the ratio of capital of each partner.

Read more from Fundamentals of Partnership

Profit and Loss Appropriation Account

Salary or commission paid to a partner

Rent paid to partner and Interest on loan