This topic is a part of the UNIT Fundamentals of Partnership Class 12 according to the CBSE curriculum.

Table of Contents

All transactions relating to partners of the firm are recorded in the books of the firm through their capital accounts. In a partnership firm, there are two methods by which partners’ capital accounts may be maintained. These are:

1/Fixed Capital Method

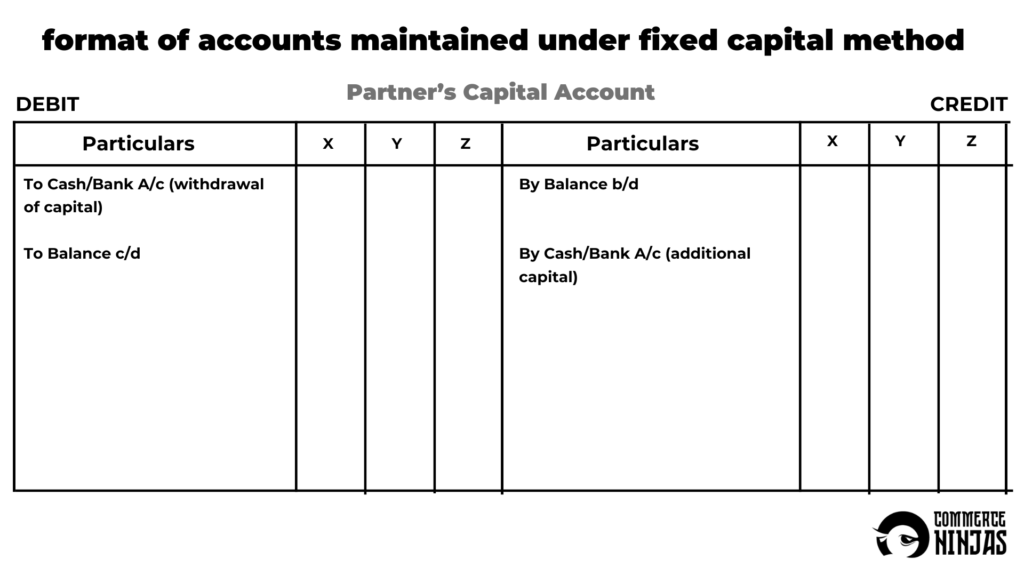

Under this method, the capitals of the partners remain fixed unless additional capital is introduced or a part of the capital is withdrawn by the partners. Two accounts are maintained under fixed capital method.

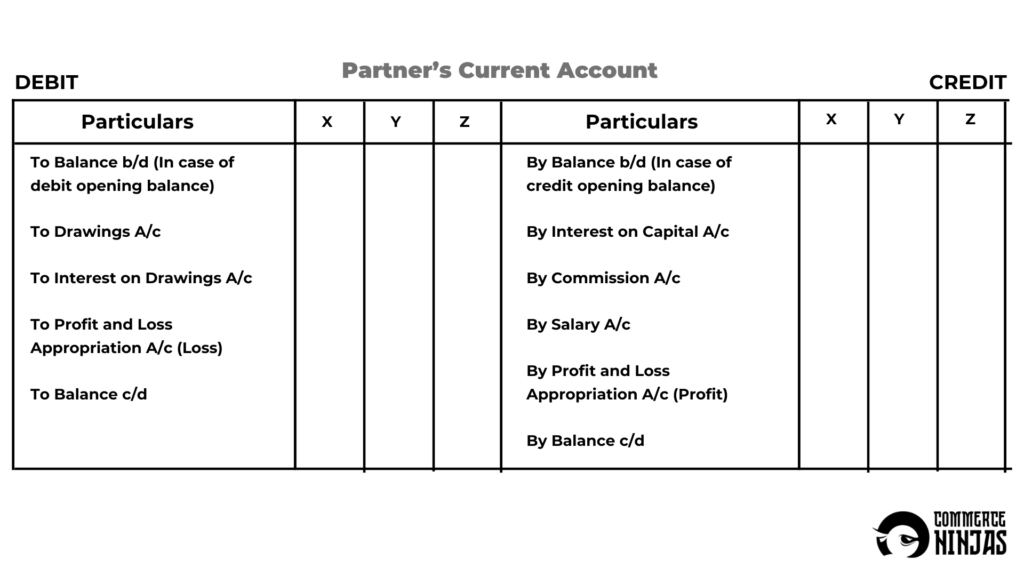

1.Capital Account: Transactions related to introduction and withdrawal of capital are recorded in capital accounts.

2. Current Account: All the other transactions (like interest on capital, drawings, salary, commission, share of profit/loss) are recorded in current account. Current account may have credit or debit balance.

Format of Accounts: Maintained under Fixed Capital Method

2/Fluctuating Capital Method

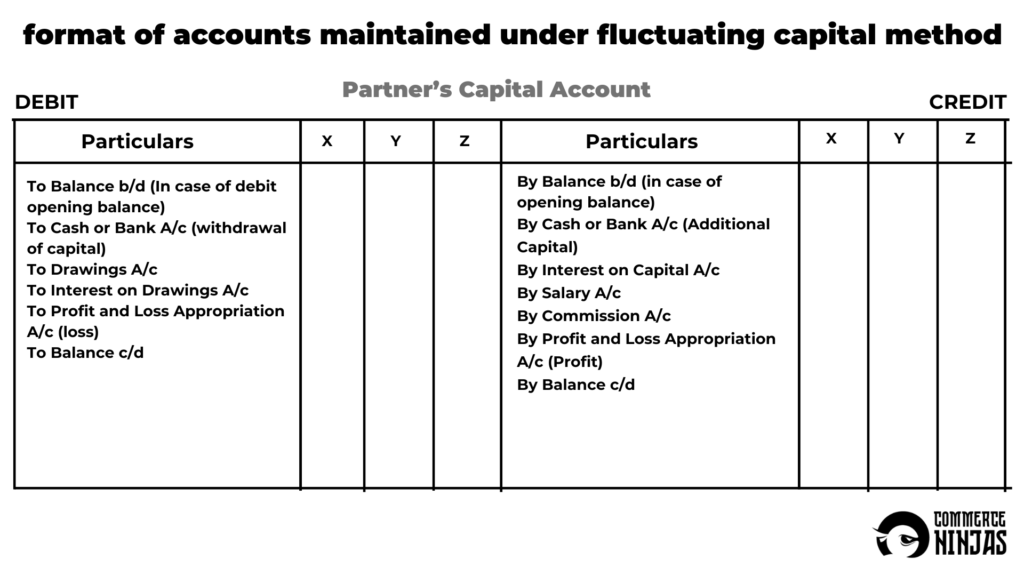

Under fluctuating capital method, only one account is maintained, i.e. capital account.

All transactions including introduction and withdrawal of capital are recorded in capital account. Generally, capital account has credit balance but in exceptional cases, it may have debit balance due to heavy losses.

Note: Unless otherwise stated, the partners’ capitals should be assumed to fluctuating.

Format of Account maintained under fluctuating Capital Method

Difference between Fixed and Fluctuating Capital Accounts

| Fixed Capital Account | Fluctuating Capital Account | |

| Number of Accounts | Under this method, two separate accounts are maintained for each partner, i.e. capital account and current account. | Under this method, each partner has only one account that is maintained and that is the capital account. |

| Adjustments | All adjustments for drawings, salary, interest on capital, etc. are made in the current account and not in the capital account | All adjustments for drawings, salary, interest on capital etc. are made in the capital account. |

| Fixed Balance | The capital account balance remains unchanged unless there is addition to or withdrawal of capital. | The balance of the capital account fluctuates from year to year. |

| Negative Balance | Fixed Capital account can never show a negative balance. | Fluctuating capital account can show a negative balance. |

Appropriation and Charge Items

Appropriation

This implies distribution of available net profits left out after providing all the expenses. Appropriations are provided only in case a firm has profits (and not in case of losses).

Appropriations are recorded (debited) to the profit and loss appropriation account.

e.g. interest on capital of partners, interest on drawings, salary or commission to a partner.

Charges

This implies deduction of expense from the profits in order to compute net profit/net loss during the accounting year. Charges are provided under all circumstances irrespective of profits and losses. Charges are recorded (debited) to the profit and loss account.

e.g. interest on loan from partner/outsider, salary/commission to employees/manager, rent to a partner/outsider.

Read more from Fundamentals of Partnership

Profit and Loss Appropriation Account

Salary or commission paid to a partner

Rent paid to partner and Interest on loan