Welcome to CommerceNinja’s handwritten solutions for TS Grewal’s Class 12 Cash Flow Statement.

Our expertly crafted notes break down complex cash flow concepts into clear, manageable steps, ensuring you grasp both preparation and interpretation.

Designed to align perfectly with your curriculum, these solutions are ideal for exam preparation and enhancing your understanding of accounting.

Explore our detailed explanations and annotations to master the cash flow statement and boost your confidence in this essential area of accounting. Happy studying!

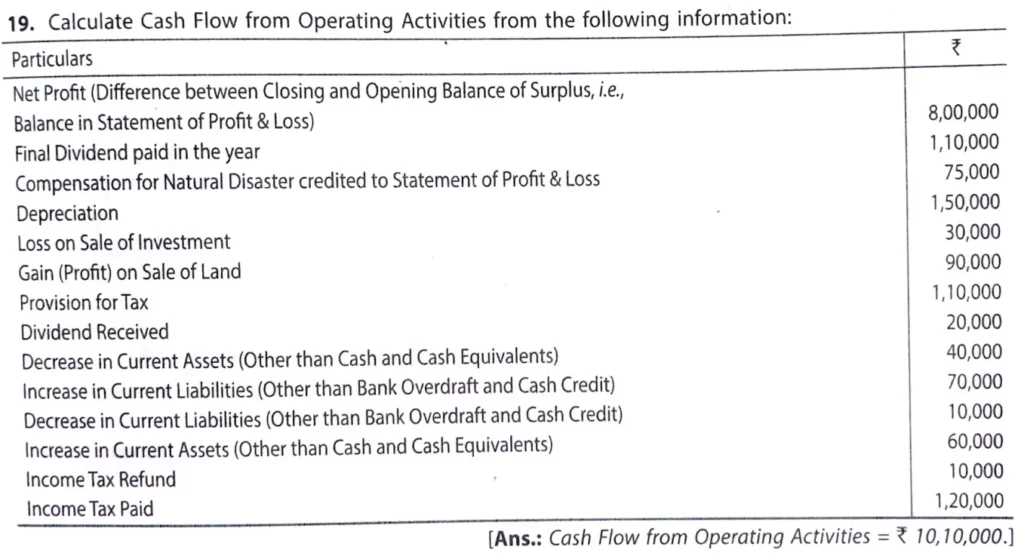

Q19. Calculate Cash flow from Operating Activities from the following information:

| Particulars | ₹ |

| Net Profit (Difference between Closing and Opening Balance of Surplus, i.e., Balance in Statement of Profit & Loss) Final Dividend paid in the year Compensation for Natural Disaster credited to Statement of Profit & Loss Depreciation Loss on Sale of Investment Gain (Profit) on Sale of Land Provision for Tax Dividend Received Decrease in Current Assets (Other than Cash and Cash Equivalents) Increase in Current Liabilities (Other than Bank Overdraft and Cash Credit) Decrease in Current Liabilities (Other than Bank Overdraft and Cash Credit) | 8,00,000 1,10,000 75,000 1,50,000 30,000 90,000 1,10,000 20,000 40,000 70,000 10,000 60,000 10,000 1,20,000 |

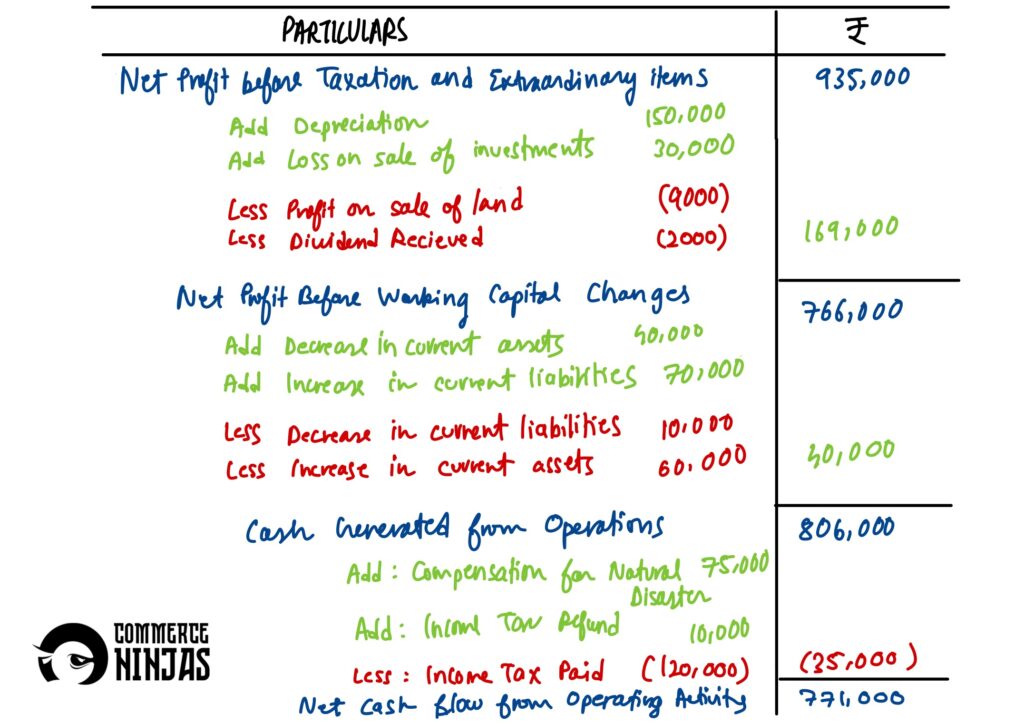

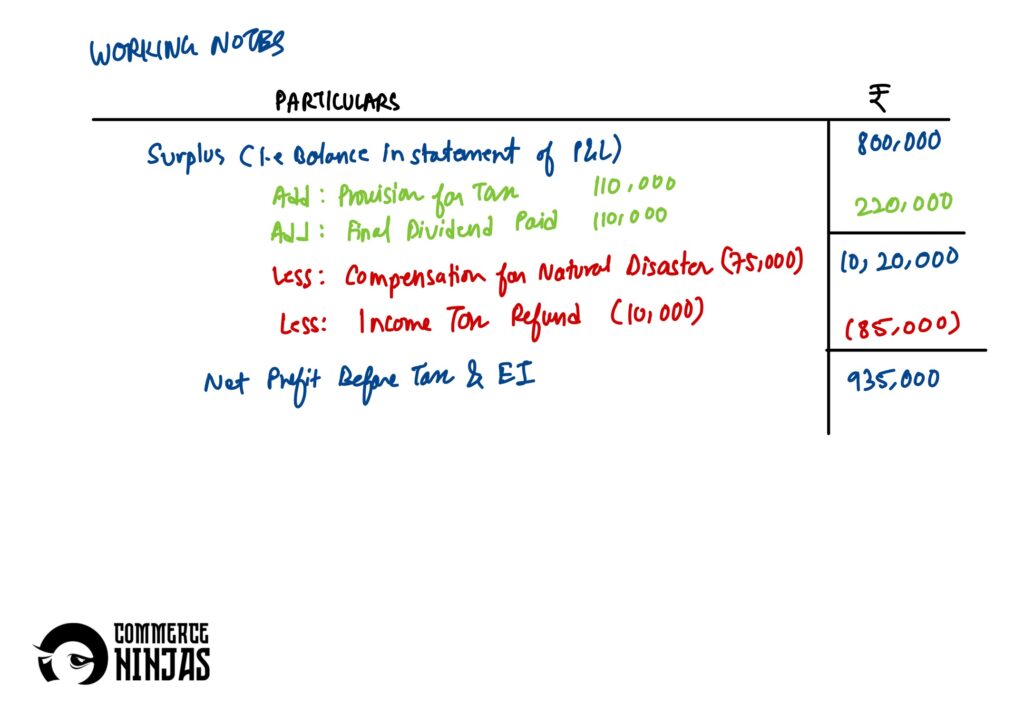

solution:

How CommerceNinjas Can Help You Score 90%+ In Commerce?

At CommerceNinjas we are dedicated to making the best and most student friendly content in the field of 11th and 12th Commerce. We provide lectures, notes, cheatsheets, planners and a lot of other resources to help you ace your CBSE Commerce.

Check out our YouTube channel for free lectures and content and our Instagram page for kuch zyada funny memes.

Chalo ab padhlo 😉