Welcome to CommerceNinja’s handwritten solutions for TS Grewal’s Class 12 Cash Flow Statement.

Our expertly crafted notes break down complex cash flow concepts into clear, manageable steps, ensuring you grasp both preparation and interpretation.

Designed to align perfectly with your curriculum, these solutions are ideal for exam preparation and enhancing your understanding of accounting.

Explore our detailed explanations and annotations to master the cash flow statement and boost your confidence in this essential area of accounting. Happy studying!

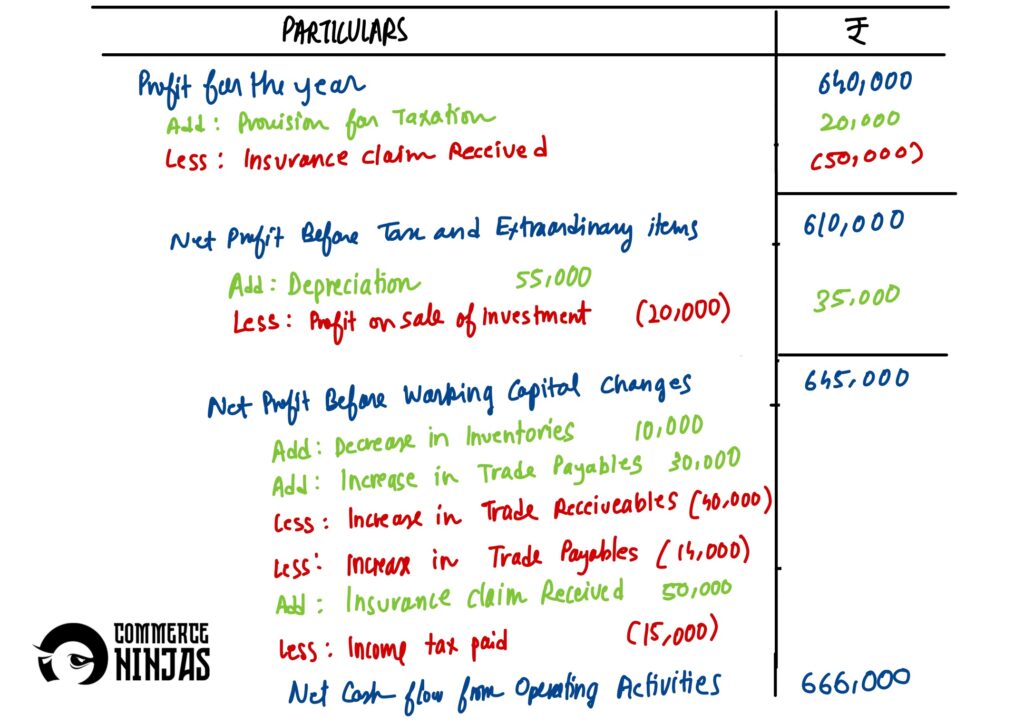

Q17.Sunrise Ltd., reported Net Profit after Tax of ₹ 6,40,000 for the year ended 31st March, 2023. The relevant extract from Balance Sheet as at 31st March, 2023 is:

| Particulars | 31st March, 2023 (₹) | 31st March, 2022 (₹) |

| Trade Receivables Prepaid Expenses Trade Payables Provision for Tax | 1,15,000 1,50,000 20,000 1,10,000 20,000 | 1,25,000 1,10,000 6,000 80,000 15,000 |

Depreciation charged on Plant and Machinery ₹ 55,000, insurance claim received ₹ 50,000, gain (Profit) on sale of investment ₹ 20,000 appeared in the Statement of Profit & Loss for the year ended 31st March, 2023. Calculate Cash flow from Operating Activities.

solution: