This chapter is a part of the UNIT Accounting For Share Capital for class 12 according to the CBSE curriculum.

Table of Contents

What are Calls-In-Arrears?

When one or more shareholders fail to pay their share capital dues at the time of allotment or call, the amount not received against the amount called, is known as calls-in-arrears.

The unpaid or arrear amount on account of allotment or calls may or may not be transferred to calls-in-arrears account.

The company may charge interest at the specified rate on calls-in-arrears from the due date to the date of payment, if the company is authorized by its Articles of Association.

In case Articles of Association is silent, Table F of the Companies Act, 2013 shall apply which provides for the payment of interest on calls-in-arrears at a rate not exceeding 10% per annum.

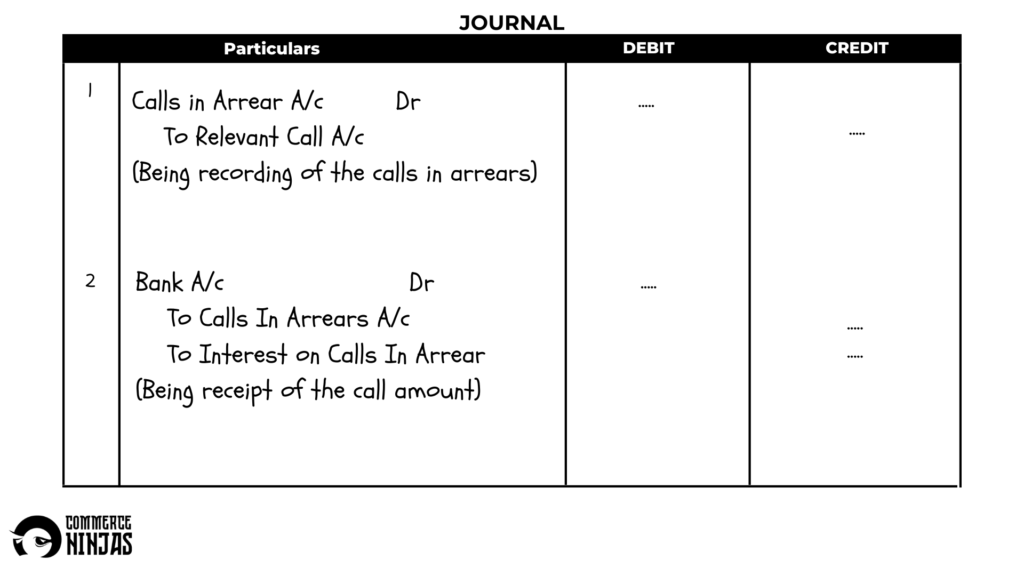

Journal Entries for Calls In Arrears (by opening the account)

Disclosure in the Balance Sheet

While preparing balance sheet, calls in arrears are shown in notes to accounts as a deduction from subscribed but not fully paid up capital.

Calls in Arrears can be dealt in the following ways

- Without Opening Calls In Arrears Account

- By Opening Calls In Arrears Account

Case 1: Without Opening Calls In Arrears Account

In this method, the amount paid by the shareholders is credited to his call account. The call account will show debit balance equal to the total unpaid amount of each call. On receiving of calls in arrears amount, bank account is debited and relevant call account is credited.

Steps to Compute Calls In Arrears in Case of Oversubscription

Following steps should be followed to compute calls in arrears in such an instance.

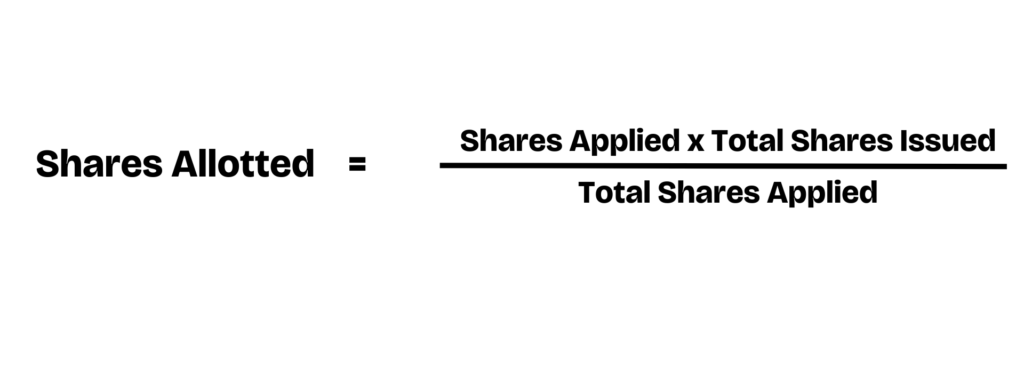

Step 1: Calculate the number of shares allotted (if shares applied are given) with the help of the following formula

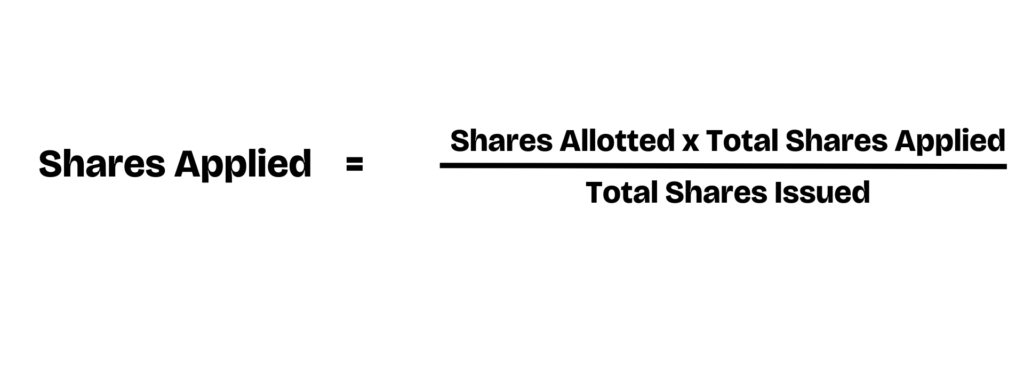

or you can also calculate the number of shares applied (if shares allotted are given) with the help of the following formula

Step 2: Calculate the excess amount paid by the shareholder at the time of application by using the following formula

Excess Amount Paid = (Shares Applied – Shares Issued) x Application Money Per Share

Step 3: Calculate the amount due at allotment to be paid by the shareholder, with the help of the following formula

Amount Due at Allotment = Shares Issued to the Shareholder x Allotment Money Per Share

Step 4: Calls In Arrears is the difference in the amounts computed in Step 3 and Step 2.

Solved Example

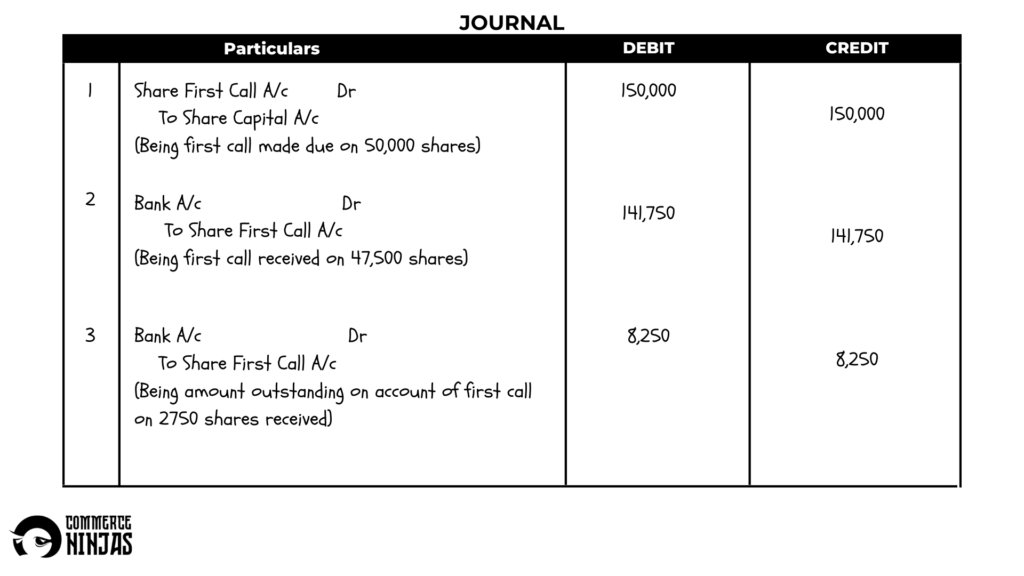

Q/ Gold Rush Ltd called the first call money of ₹ 3 per share on its 50,000 shares. Dibakar who holds 2,750 shares of the company failed to pay the above amount by the due date of 15th August. However, he later on paid the amount on 30th August. Journalize in the books when calls-in-arrears account is not to be opened.

Solution:

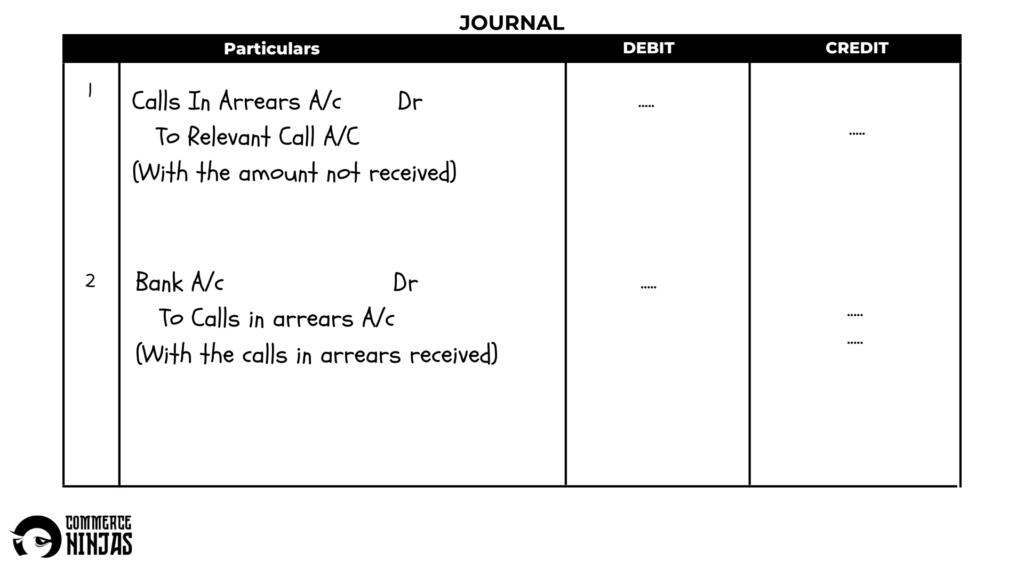

Case 2: By Opening Calls In Arrears Account

In this method, the amount of calls in arrears is transferred to an account namely calls in arrears account. If the amount of calls not paid by some shareholders is transferred to calls in arrears account, allotment and other call accounts will not show any balance.

The balance in calls in arrears account will show a debit balance equal to the total unpaid allotment and call money. Later, on receipt of amount, it is credited to calls in arrears account.

Accounting treatment for case 2

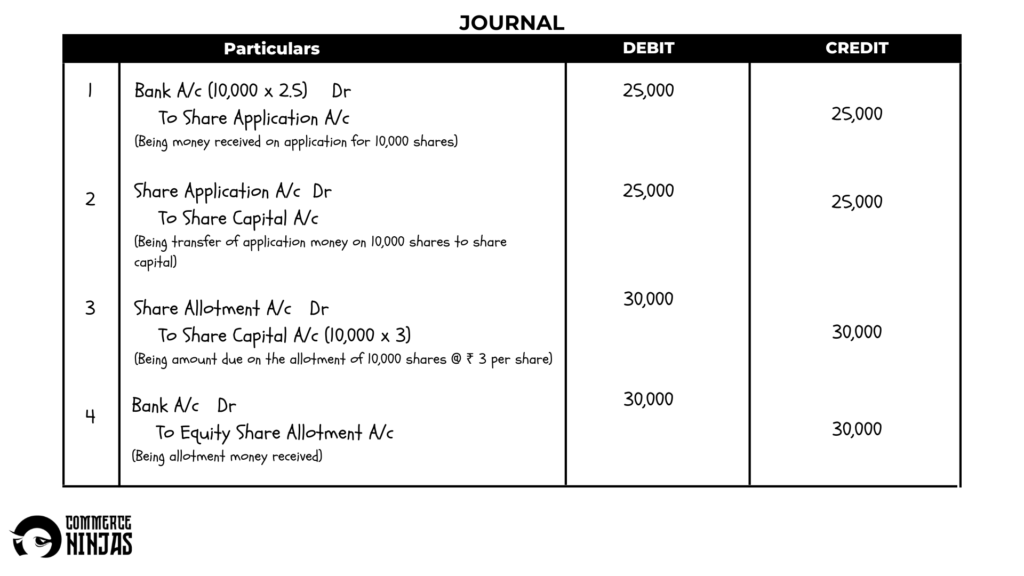

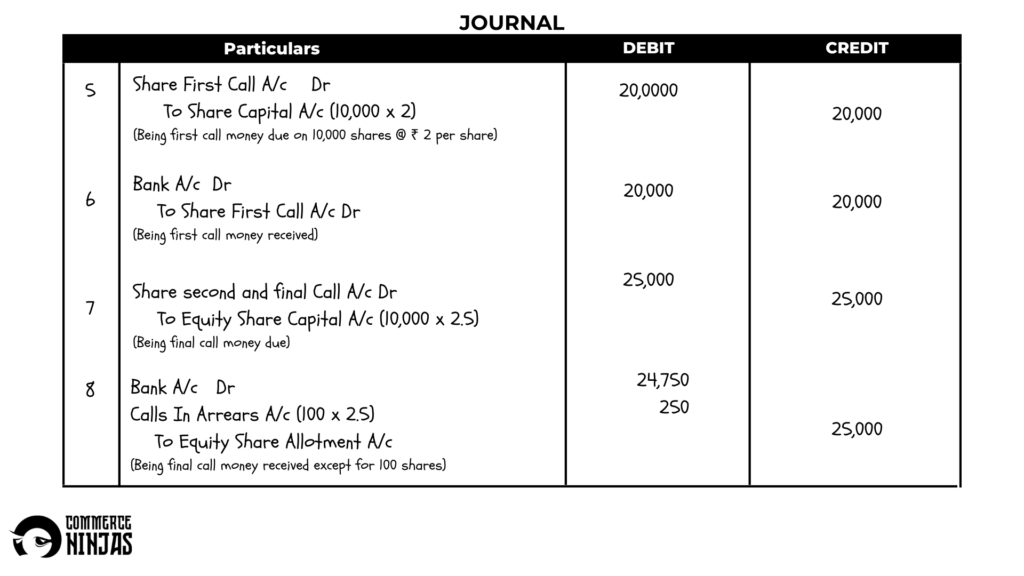

Solved Example

Q/ Cronic Ltd. issued 10,000 equity shares of ₹ 10 each payable at ₹ 2.50 on application, ₹ 3 on allotment, ₹ 2 on first call and the balance of ₹ 2.50 on the final call. All the shares were fully subscribed and paid except of a shareholder having 100 shares who could not pay for the final call. Give journal entries to record those transactions.

What is the difference between Calls In Arrears and Calls In Advance?

| Basis for Comparison | Calls In Arrears | Calls In Advance |

| Meaning | Non-payment of the amount due on allotment or subsequent calls by shareholders. | Prepayment of uncalled amounts on shares by shareholders. |

| Nature of Balance | Shows a debit balance. | Shows a credit balance. |

| Max Interest Rate | Company can charge interest at 10% for the intervening period. | Company must pay interest at 12% from the date received until appropriated. |

| Instalment Status | The company has called the installment but it remains unpaid. | The company has not yet called the installment; payment is made in advance. |

| Legal and Administrative Aspects | May require legal actions to collect dues, adding to costs. | Requires less administrative effort; no legal actions for collection needed. |

Frequently Asked Questions about Calls In Arrears

Is Calls in Arrears a current liability?

While calls in advance are classified as a current liability, calls in arrears are not. They are simply deducted from called-up capital to arrive at the paid-up capital figure on the balance sheet.

How to present the calls in arrears on the balance sheet?

The calls in arrears also appeared in the liabilities section of the balance sheet by deducting the amount from called-up capital. If the amount is forfeited, the amount is debited or subtracted from the forfeited account.

What is the difference between calls in advance and calls in arrears?

The non-paid amount by the shareholders is the amount of call in arrears, and the prepaid amount in advance of the uncalled amount on the shares by one or more than one shareholder is the number of calls in advance.

What is the Provision for Calls in Arrears?

The provision for calls in arrears refers to unpaid amounts due from shareholders on shares. It is recorded as a deduction from called-up capital on the balance sheet. Companies can charge interest on these arrears, typically at 5% per annum. Non-payment may lead to share forfeiture, governed by the company’s Articles of Association and relevant laws.