What is Meant by Issue of Shares for Considerations other than the Cash?

Sometimes, a company issues shares in payment (consideration) against purchase of assets or business or to promoters/underwriters in appreciation for their services.

This is referred to as ‘issue of shares for consideration other than cash’.

These shares can be issued either at par or at premium and the number of shares to be issued depends on the price at which the shares are issued and the amount payable.

These shares can be issued to vendors, promoters or underwriters as discussed ahead.

Issue of Shares to Vendors

On Purchase of Assets or Business

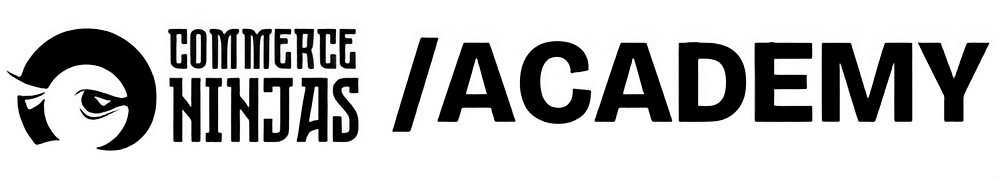

In this regard, the purchase of assets and issue of shares are to be treated as two separate transactions.

What is Purchase Consideration?

It is the amount paid by purchasing company in consideration for purchase of assets/business from the vendor. ‘Vendor’ is credited with purchase consideration payable to him.

It may be given in the question. If not, it can be computed using the following formula.

Purchase Consideration = Sundry Assets – Sundry Liabilities, which is equivalent of ‘Net Assets’.

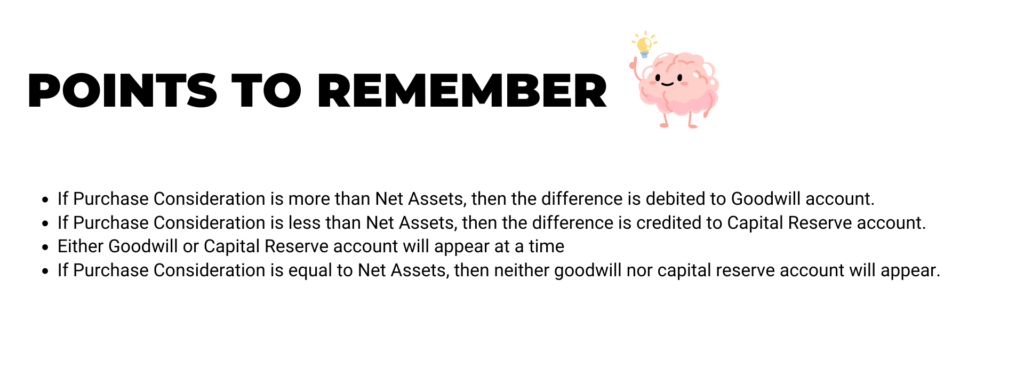

On Issue of Shares

How many number of shares to be issued?

Number of Shares to be Issued = Amount Payable / Issue Price (Face Value + Premium)

Issue Of Shares for Consideration other than Cash (for vendors) examples

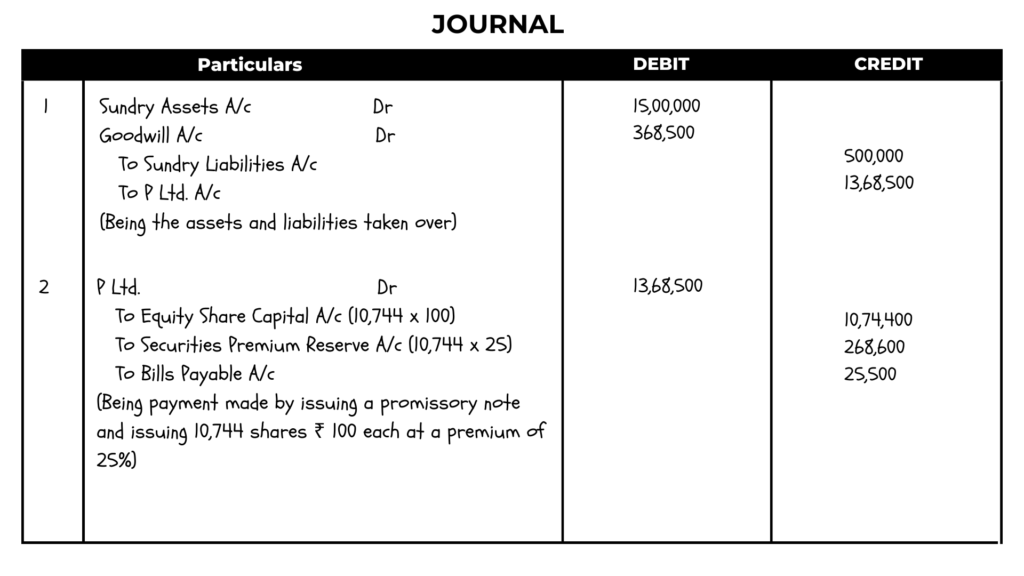

Q1/ K Ltd. took over assets of ₹ 15,00,000 and liabilities ₹ 5,00,000 of P Ltd. for a purchase consideration of ₹ 13,68,500. ₹ 25,000 were paid by issuing a promissory note in favor of P Ltd. payable after two months and the balance was paid by issue of equity shares of ₹ 100 each at a premium of 25%. Pass necessary journal entries for the above transactions in the books of K ltd.

Solution:

Working Note: Number of shares issued = 13,43,000 (13,68,500 – 25,500) / 125 (100 + 25) = 10,774 shares.

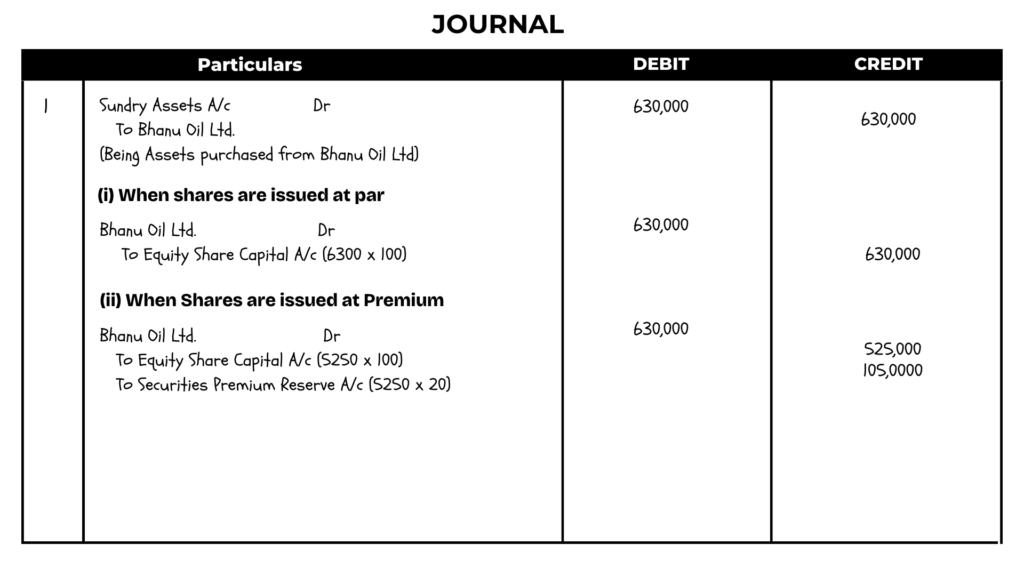

Q2/ Kumar Ltd. purchased assets of ₹ 6,30,000 from Bhanu Oil Ltd. Kumar Ltd issued equity shares of ₹ 100 each fully paid in consideration. What Journal entries will be made, if the shares are issued (i) at par and (ii) at premium of 20%.

Solution:

Working Note:

Number of shares to be issued = Amount Payable / Face Value per Share

Case (i) 630,000 / 100 = 6300 shares

Case (ii) 630,000 / (100 + 20) 120 = 5250 shares

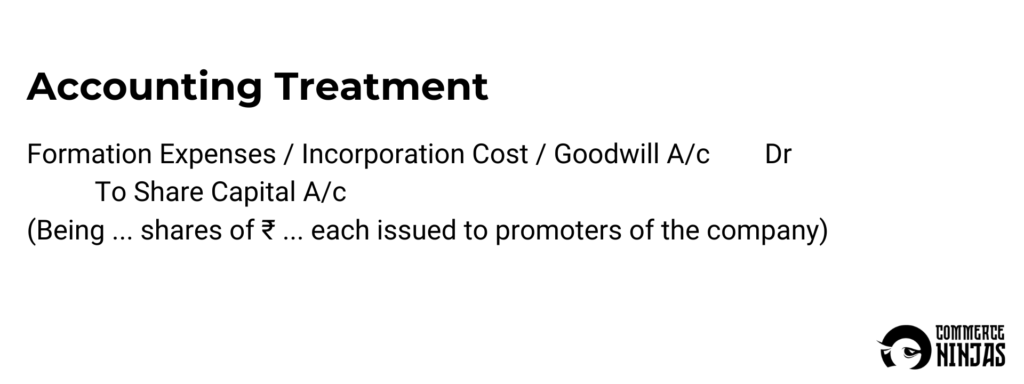

Issue Of Shares to Promoters

The persons like individuals, firms or companies which promote the company are called promoters. Sometimes, companies issue shares to promoters for their services to the company. Such issue of shares is put under the category of issue of shares for considerations other than cash.

From accounting viewpoint, it is non incorporation cost or formation expenses.

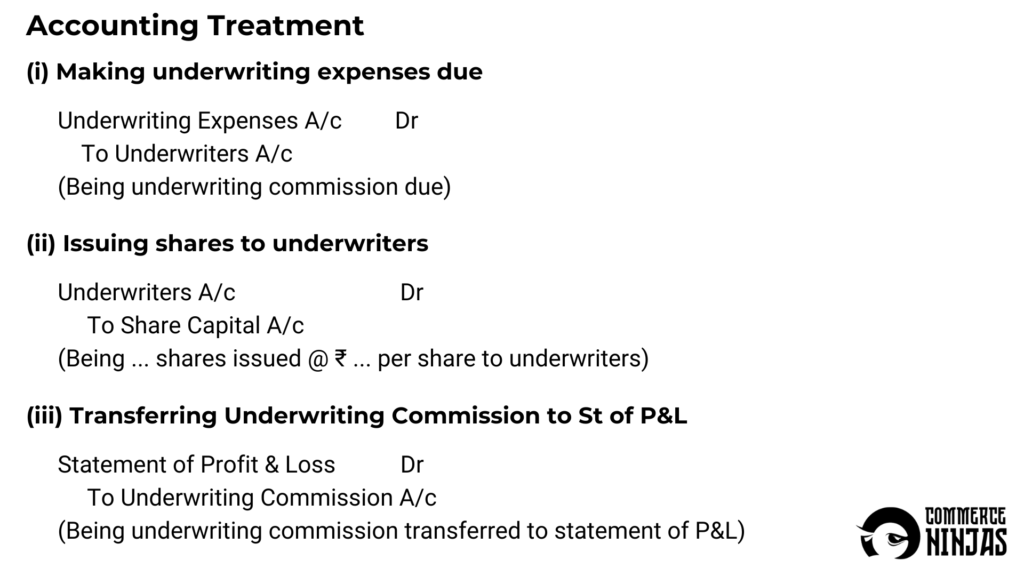

Issue of Shares to Underwriters

Underwriter is a person who works closely with the issuing body to determine the offering price of the securities. Underwriters buys securities from the issuers and sells them to investor via the underwriter’s distribution network.

Sometimes, underwriters are issued shares as their fees by the issuing company.

Issue Of Shares for Consideration other than Cash (promoters and underwriters) examples

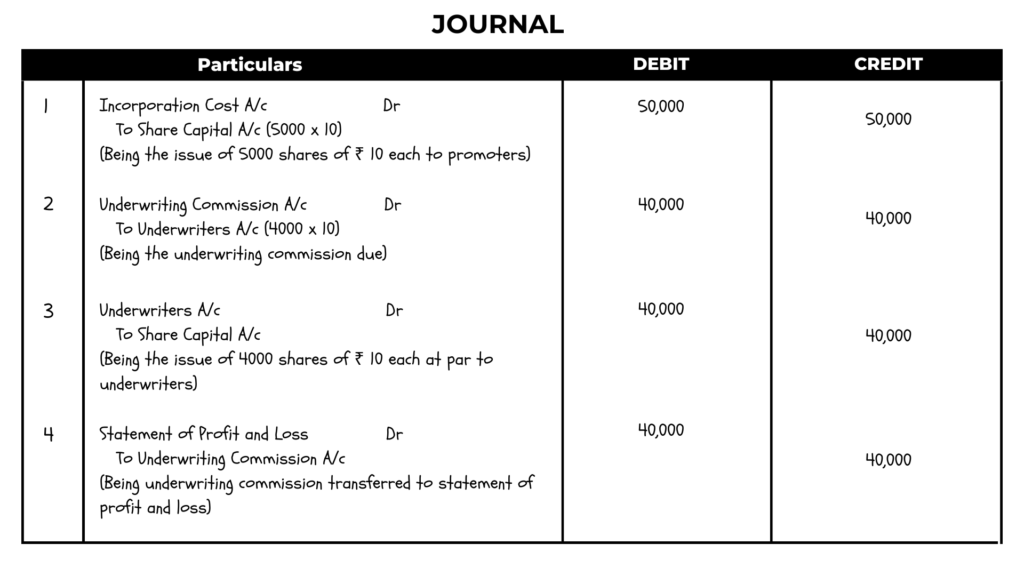

Q3/ Dukes Ltd. issued 5,000 shares of ₹ 10 each credited as fully paid to promoters for their services and issued 4,000 shares of ₹ 10 each credited as fully paid to the underwriters for their underwriting services. Journalize these transactions.

Solution:

Disclosure of Shares Issued for Consideration other than Cash in the Balance Sheet

Shares issued for consideration other than cash are disclosed under subscribed share capital in the notes to accounts on share capital (either as subscribed and fully paid up or subscribed but not fully paid up, as the case may be).

FAQs

Can companies issue debentures for considerations other than cash?

Yes, definitely. Companies can issue debentures for considerations other than shares just like their equity counter part equity shares.

Will the issue of shares for consideration other than cash result in cash flow?

No, they won’t. As they are issued for other tangible goods and not for either cash or cash equivalents like Marketable Securities.

When the shares are issued for considerations other than cash which account will be credited?

When the shares are issued for considerations other than cash the share capital account will be credited. As we are just issuing normal equity or preference shares but this time around we are not doing it for cash but rather something else.

What is the formula for finding out the number of shares to be issued?

Number of shares to be issued = Amount Payable / Face Value per share (Face value + Premium)