This chapter is a part of the UNIT Accounting For Share Capital for class 12 according to the CBSE curriculum.

Table of Contents

A company raises its capitals by issues of shares.

A company may issue shares either.

1/For Cash: When the company receives cash against the issued shares, shares are said to have been issued for cash.

2/For Consideration other than Cash: When a company issues shares in consideration against purchase of fixed assets, it is said to have been issued for considerations other than cash.

Terms of Issue of Shares

A company may issue shares

At Par

When shares are issued at their face value, the shares are said to have been issued at par i.e., issue price and face value are same. e.g. share with a face value of ₹10 is issued at ₹10.

At Premium

When shares are issued at a value that is higher than the face value of shares, the shares are said to have been issued at premium i.e. issue price is more than face value. e.g. share with a face value of ₹10 is issued ₹15, premium being ₹5.

At Discount

When shares are issued at a price which is lower than than the face value, shares are said to be issued at discount.

It is important to note that as per Section 35 of the Companies Act, 2013, companies would no longer be permitted to issue shares at a discount.

The only shares that could be issued at a discount are sweat equity wherein shares are issued to employees or directors in lieu of their services under Section 54 of 2013 act.

Important Terms Related to Issue of Shares

Following are the important terms related to issue of shares:

Securities Premium Reserve

The excess of issue price of shares over its face value is termed as the securities premium reserve. The Companies Act, 2013 requires that the amount of the premium received should be credited to securities premium reserve account. Securities Premium Reserve is a capital receipt.

Securities Premium Reserve account is shown in the balance sheet under the main head ‘shareholders funds’ and sub-head ‘reserves and surplus’.

Section 52(2) of the Companies Act, 2013 restricts the use of the amount received as premium on securities for the following purposes.

(a) In Purchasing its own shares (buy-back)

(b) Issuing fully paid bonus shares to the members

(c) Writing-off the expenses of, or the commission securities or debentures of the company

(d) Providing for the premium payable on the redemption of any redeemable preference shares or of any debentures of the company.

(e) Writing-off preliminary expenses of the company.

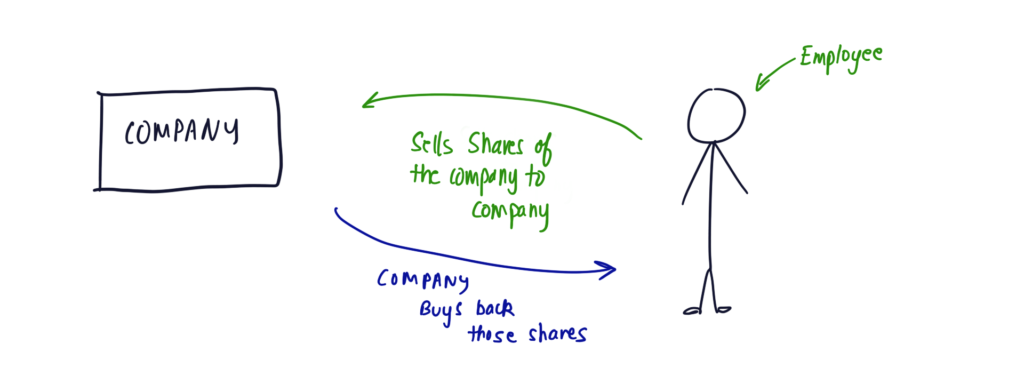

Buy-Back of Shares

The term ‘buy-back’ of shares implies the act of purchasing its own shares by the company. Sources of funds for buy-back are [Section 52(2)].

- Free Reserve

- The securities premium reserve account

- The proceeds of any shares or other specified securities

Preliminary Expenses

The expenses incurred in the promotion and formation of the company are known as preliminary expenses such as registration fee paid to registrar of companies, stamp duty, legal expenses, expenses regarding preparation and issue of prospectus, etc. Preliminary expenses are written-off in the year in which they are incurred.

Preliminary expenses are also known as incorporation expenses, promotion expenses and formation expenses.

Modes of Issuing Shares

When a company is issuing shares for cash, it has two possible modes.

1/Private Placement of Shares

It means issue and allotment of shares to a selected group of persons privately and not to public in general.

It is generally made by private or unlisted companies.

When a company issues shares through private placement route, a special resolution to this effect should be passed.

All SEBI guidelines concerning preferential issue are applicable to private placement of shares as well.

In case of private placement of shares, the allottees will not sell their shares or a minimum period of three years from the date of allotment. This period is called ‘lock in period’.

2/Public Issue of Shares

It means offer made by a company to public in general for subscription of shares offered. Making an offer or inviting the public in general to subscribe for shares is know as Initial Public Offer (IPO).

It means that a company is issuing that category of shares for the first time. When a public issue of shares is being made, the following steps are required to be taken by the company.

(i) To Issue Prospectus: Prospectus is basically an invitation to the public to subscribe for the shares of the company.

The prospectus contains the details about the company, such as the names and addresses of the registered office, name and addresses of the directors, objects of the company , profitability and financial position of the company, authorized and issued capital of the company, number of shares offered for subscription, terms of issue, etc.

The prospectus basically aims to induce public to apply for shares of the company.

(ii) To Receive Application: In this stage, public applies for the shares, if they are impressed by the company’s prospectus and believe it to be safe. Each application should be accompanied with the application money.

The application money not be less than 25% of the issue price of each share (as per SEBI guidelines). The application money should be deposited in a scheduled bank.

On the basis of applications received by the public, an issue may be fully subscribed, oversubscribed or undersubscribed.

(iii) To Make Allotment of Shares: When the last date for making applications lapses, the bank sends the application letters and money to the company. Before allotting the shares to the applicants, first of all, the directors have to ensure that minimum subscription has been received by the company.

(iv) To make calls: If the company has not called-up the entire issue price at the time of application and allotment, then subsequent installments are termed as calls, such as first call, second call, final call, etc. Calls should be made according to the terms laid down in articles of association. In the absence of Articles of Association, Table F of Companies Act will apply.

Accounting Treatment of Issue of Shares for Cash

Accounting treatment for shares issued can be discussed under two heads i.e., when amount is payable in lumpsum and when the amount is payable in installments.

1/Shares Payable in Lumpsum

Shares are said to have been issued against lumpsum payment when amount is payable in one installment.

Journal entries are follows:

| For receiving share application money | Bank A/c Dr To Share Application and Allotment A/c (Being Application money received) |

| For allotment of shares | At Par Share Application and Allotment A/c Dr To Share Capital A/c (Being the shares allotted and application money transferred to share capital A/c) |

RV Corp. Ltd. issued at 40,000 equity shares of ₹10 each at a premium of ₹2 payable along with the application. All the shares were applied and duly allotted. Pass necessary journal entries and also show the balance sheet of the company.

| Date | Particulars | Debit | Credit |

| 1 | Bank A/c (40,000 x 12) Dr To Share Application and Allotment A/c | 480,000 | 480,000 |

| 2 | Equity Share Application & Allotment A/c Dr To Share Capital A/c To Securities Premium A/c | 480,000 | 400,000 80,000 |

2/Shares Payable in Installments

The amount against the shares may be received in instalments. First instalments is called application money (it is paid along with the application). Second instalment is called allotment money (it is collected by the company at the time of allotment).

After allotment of shares, the remaining part of share money, when called-up, is known as Call Money. It may be collected in one or more instalments. If only one call is made, then it is called first and final call in place of first call, otherwise the word ‘final’ will be added to the last installment.

The issue price of shares can be received by the company in instalments and these instalments are referred to as:

| First Instalment | Application money payable along with application |

| Second Instalment | Allotment money payable at the time of allotment |

| Third Instalment | First Call |

| Fourth, Fifth and Sixth Instalment | Second Call, third call and so on |

| Last Instalment | Final Call |

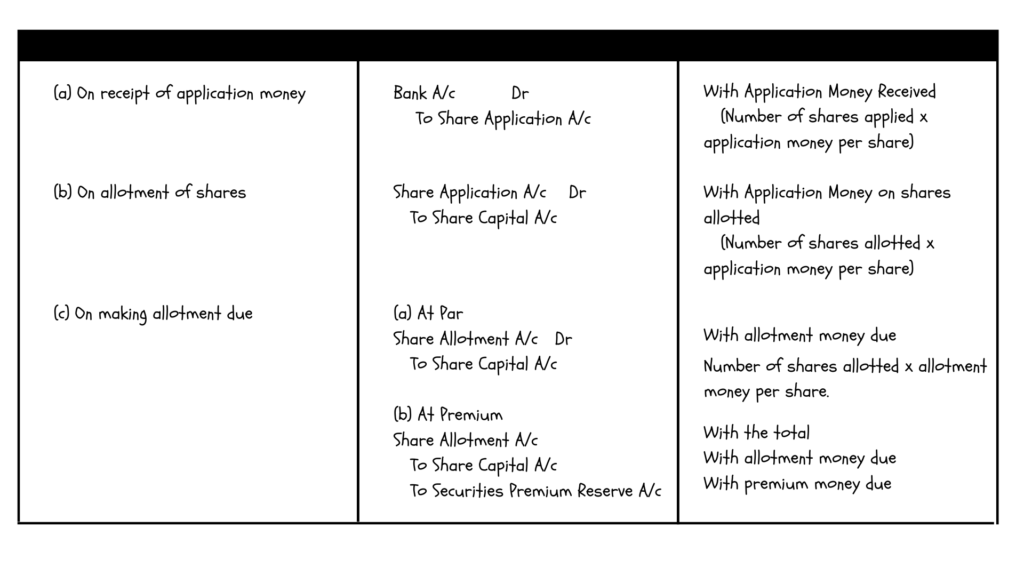

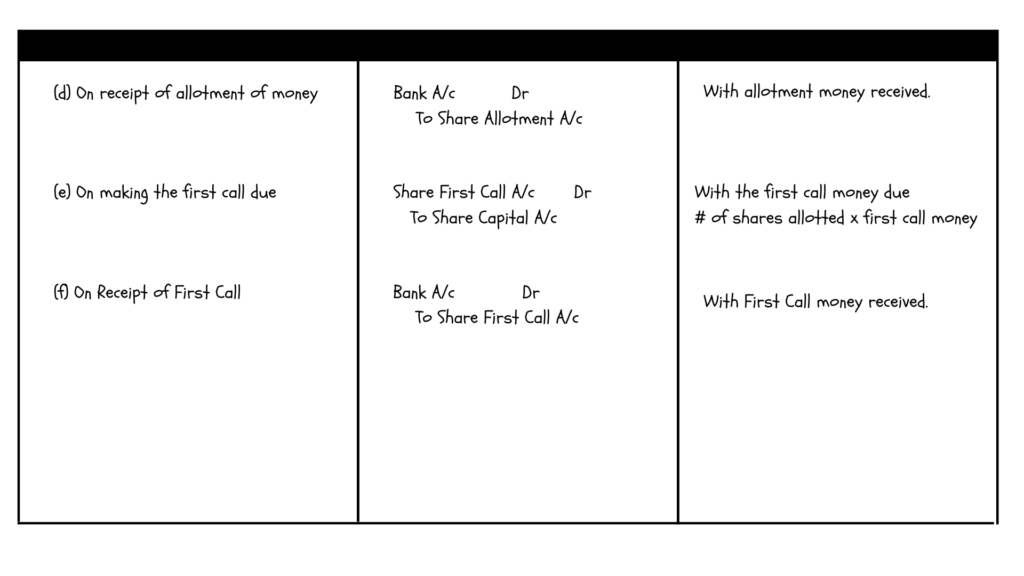

The journal entries required to be passed as: