Welcome to CommerceNinja’s solutions for TS Grewal’s Class 12 Cash Flow Statement. For the session 2024-25.

Our expertly crafted notes break down complex cash flow concepts into clear, manageable steps, ensuring you grasp both preparation and interpretation.

Designed to align perfectly with your curriculum, these solutions are ideal for exam preparation and enhancing your understanding of accounting.

Explore our detailed explanations and annotations to master the cash flow statement and boost your confidence in this essential area of accounting. Happy studying!

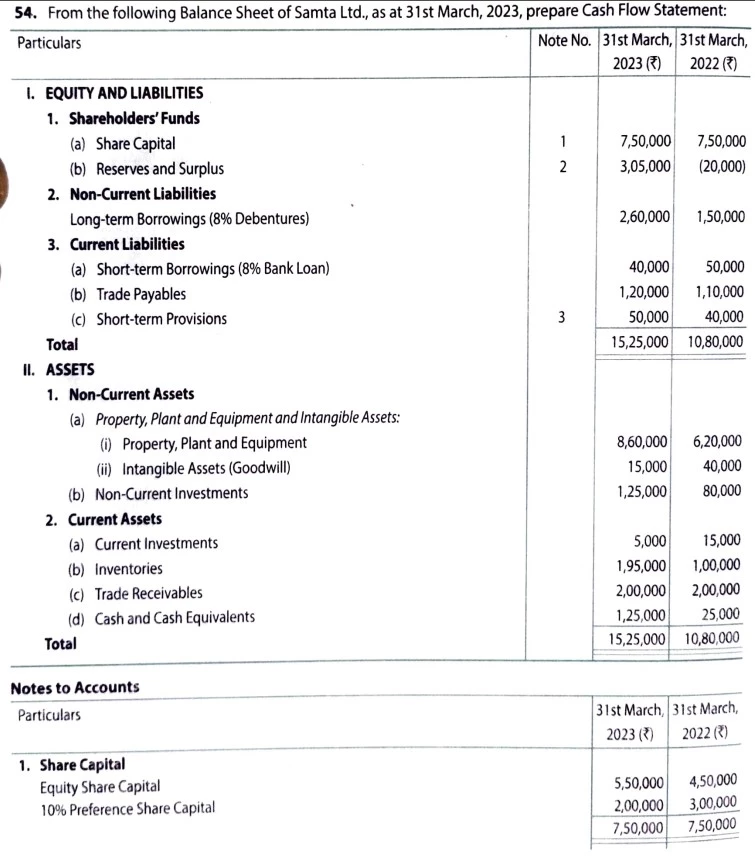

Q.54 From the following Balance Sheet of Samta Ltd., as at 31st March, 2023, prepare Cash Flow Statement:

| Particulars | 31st March, 2023 (₹) | 31st March, 2022 (₹) |

| I. EQUITY AND LIABILITIES | ||

| Shareholder’s Funds (a) Share Capital (b) Reserves and Surplus | 7,50,000 3,05,000 | 7,50,000 (20,000) |

| Non-Current Liabilities Long-term Borrowings (8% Debentures) | 2,60,000 | 1,50,000 |

| Current Liabilities (a) Short-term Borrowings (8% Bank Loan) (b) Trade Payables (c) Short-term Provisions | 40,000 1,20,000 50,000 | 50,000 1,10,000 40,000 |

| Total | 15,25,000 | 10,80,000 |

| II. Assets | ||

| Non-Current Assets (a) Property, Plant and Equipment and Intangible Assets: (i) Property, Plant and Equipment (ii) Intangible Assets (Goodwill) (b) Non-Current Investments | 8,60,000 15,000 1,25,000 | 6,20,000 40,000 80,000 |

| Current Assets (a) Current Investments (b) Inventories (c) Trade Receivables (d) Cash and Cash Equivalents | 5,000 1,95,000 2,00,000 1,25,000 | 15,000 1,00,000 2,00,000 25,000 |

| Total | 15,25,000 | 10,80,000 |

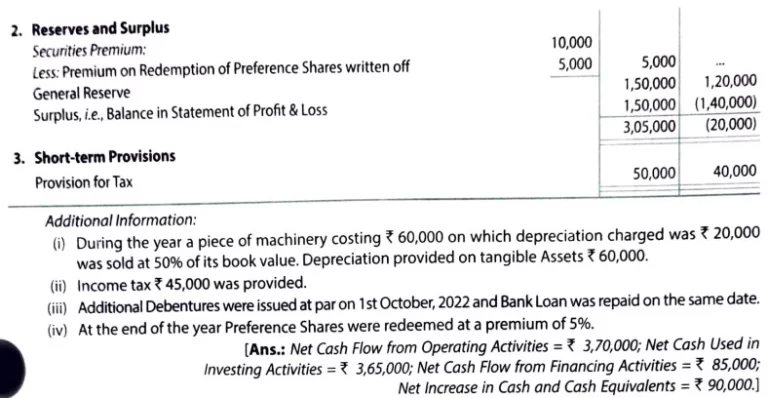

| Particulars | 31st March, 2023 (₹) | 31st March, 2022 (₹) | |

| Share Capital Equity Sahre Capital 10% Preference Share Capital | 5,50,000 2,00,000 | 4,50,000 3,00,000 | |

| Reserves and Surplus Securities Premium: Less: Premium on Redemption of Preference Shares written off General Reserve Surplus, i.e., Balance in Statement of Profit & Loss | 10,000 5,000 | 5,000 1,50,000 1,50,000 | – 1,20,000 (1,40,000) |

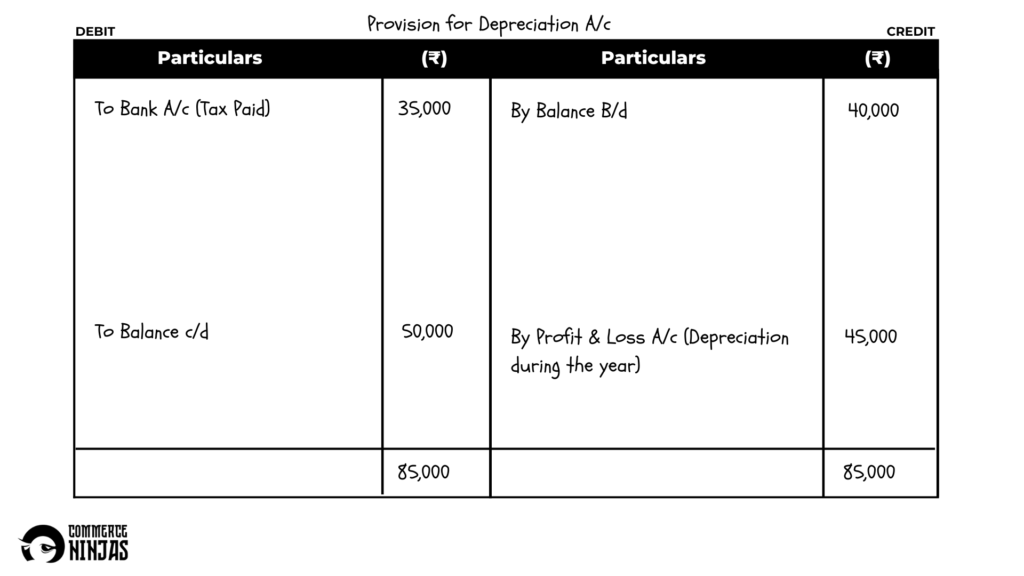

| Short-term Provisions Provision for Tax | 50,000 | 40,000 |

Additional Information:

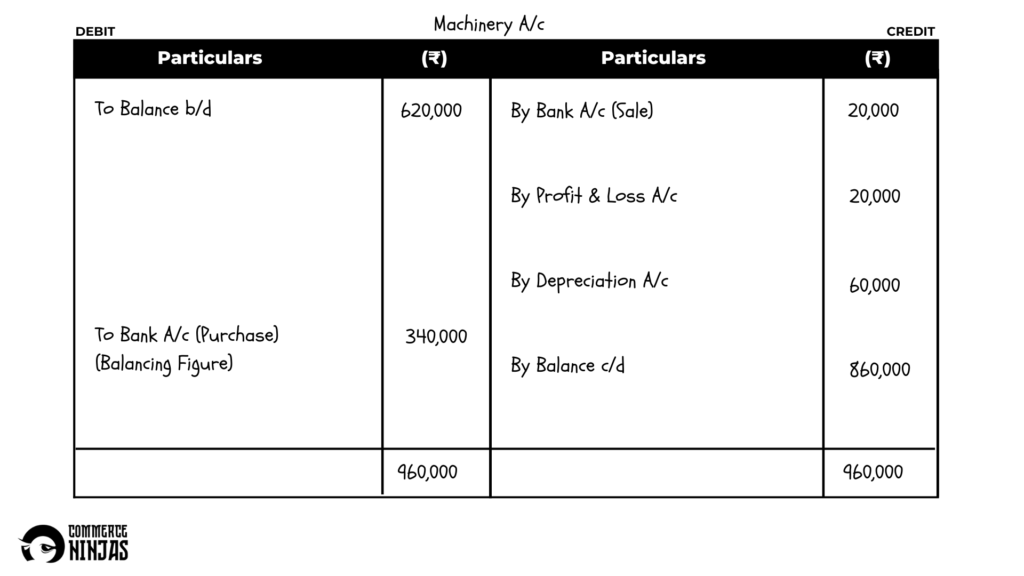

(i) During the year a piece of machinery costing ₹ 60,000 on which depreciation charged was ₹ 20,000 was sold at 50% of its book value. Depreciation provided on tangible Assets ₹ 60,000.

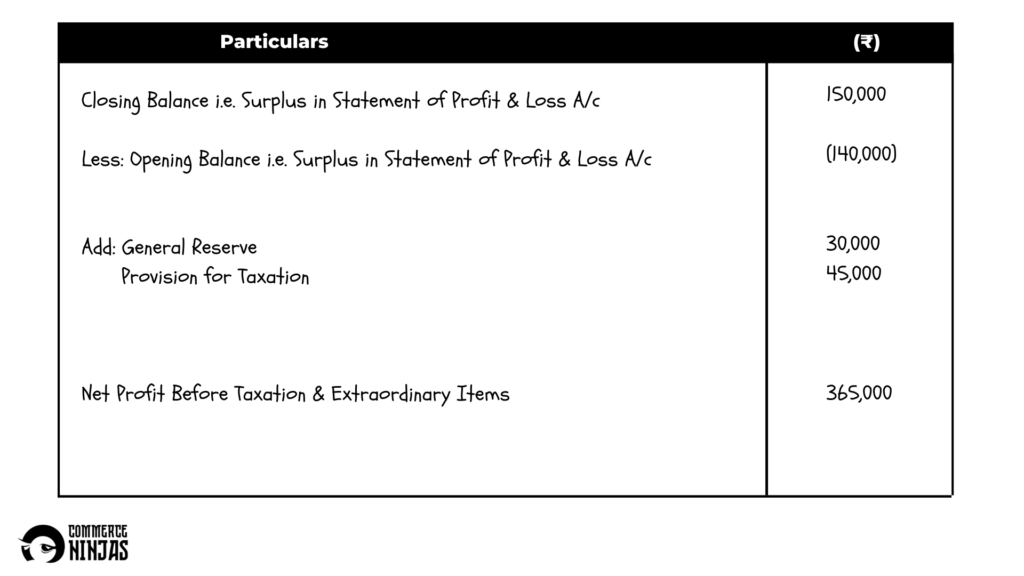

(ii) Income Tax ₹ 45,000 was provided.

(iii) Additonal Debentures were issued at par on 1st October, 2022 and Bank Loan was repaid on the same date.

(iv) At the end of the year Preference Shares were redeemed at a premium of 5%.

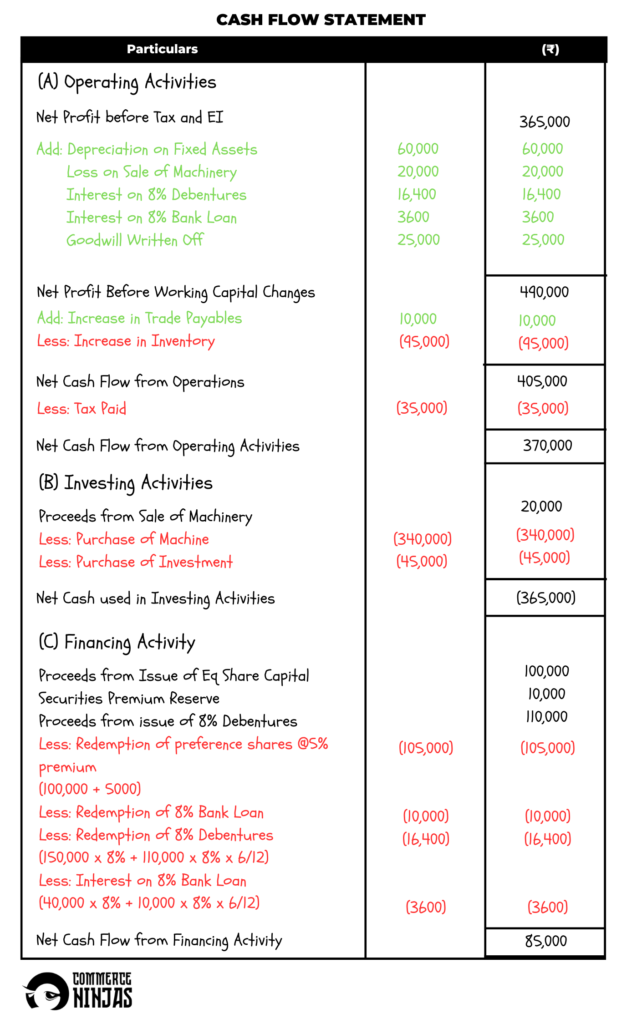

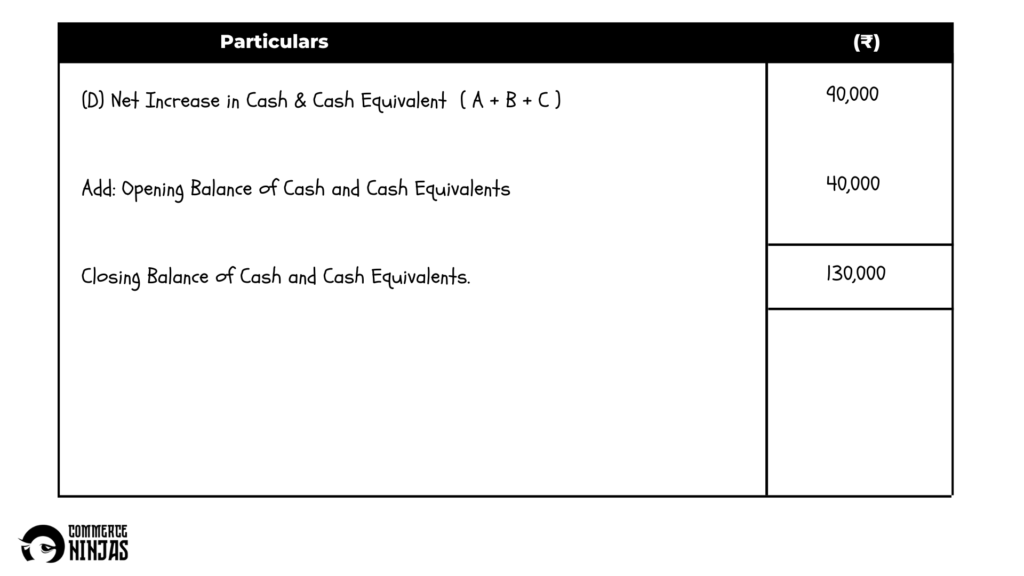

SOLUTION:

How CommerceNinjas Can Help You Score 90%+ In Commerce?

At CommerceNinjas we are dedicated to making the best and most student friendly content in the field of 11th and 12th Commerce. We provide lectures, notes, cheatsheets, planners and a lot of other resources to help you ace your CBSE Commerce.

Check out our YouTube channel for free lectures and content and our Instagram page for kuch zyada funny memes.

Chalo ab padhlo 😉