This topic is a part of the UNIT Fundamentals of Partnership Class 12 according to the CBSE curriculum.

The amount withdrawn by partners in cash or in kind for their personal use is termed as drawings. And the interest charged on that drawing is known as Interest on Drawings.

Drawings against Profit

This are the part of profits which is withdrawn for personal use. This withdrawal is made out of profits, so it does not effect the fixed capital of the partner, i.e. these drawings are debited to drawings account and not to the capital account of the partner. Interest is charged on such drawings.

Drawings against Capital

This means part of capital is withdrawn for personal use. This withdrawal is made out of capital, so it reduces the fixed capital of the partner, or these drawings are debited to partners’ capital account. Interest is not charged on such drawings.

No interest is charged on drawings, if partnership agreement is silent about interest on drawings.

Interest on drawings is an income/gain for the firm and hence is credited to profit and loss appropriation account.

On the other hand, interest on drawings is a expense/loss to the partner and hence is debited to his capital account (in case of fluctuating capital) or current account (in case of fixed capital).

Calculation of Interest on Drawings

Case 1: When fixed amount is withdrawn at fixed intervals.

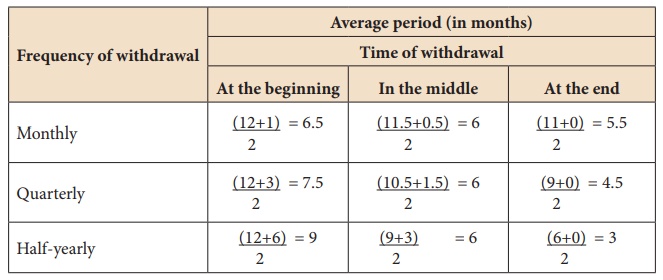

When fixed amount is withdrawn by the partners, it may be withdrawn at the beginning (first day) of the month, middle of the month or at the end (last day) of the month.

When fixed amount is withdrawn at fixed intervals, following steps are used

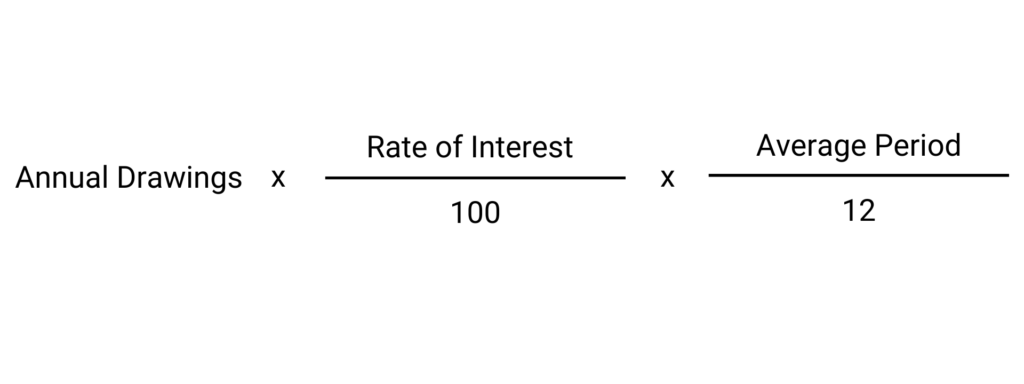

Step 1: Find annual drawings

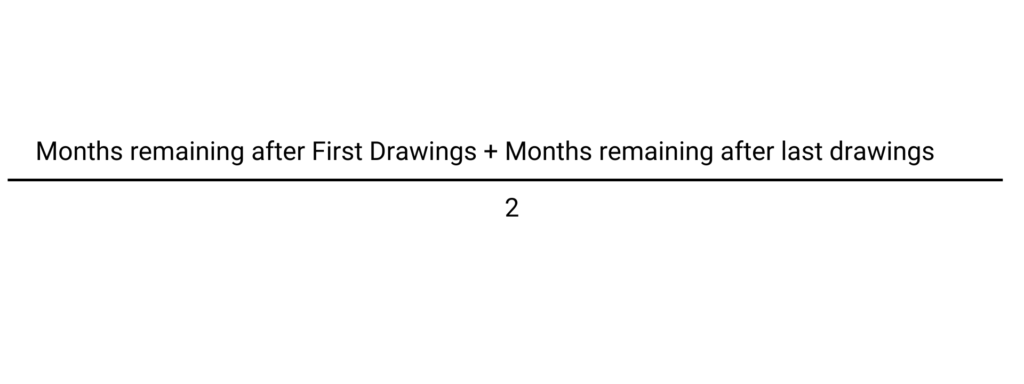

Step 2: Find Average Period

Step 3: Find Interest on Drawings

Here is a diagram you can refer to for Average Period.

Case 2: When unequal amount is withdrawn at irregular intervals

When unequal amount is withdrawn at different dates, the interest on drawings is calculated with the following two methods.

Simple Method

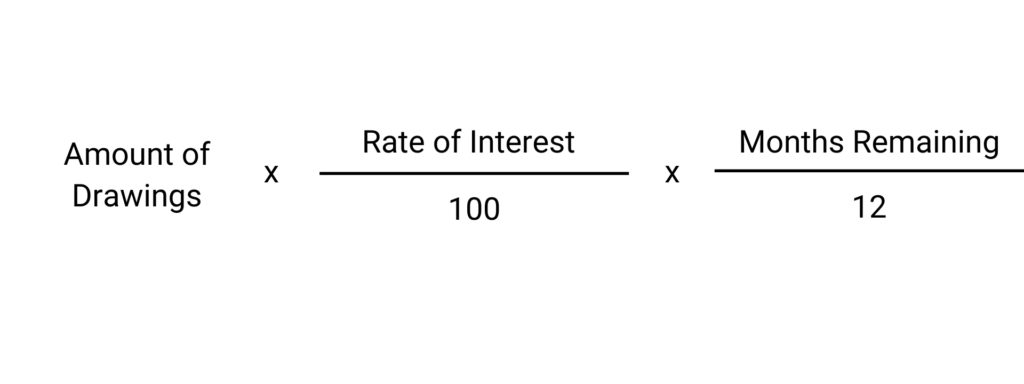

In this method, interest on drawings is calculated for every individual drawings considering the time for which it is used. Following table will be used

| Date of Drawings | Amount of Drawings | Number of Months Remaining in the Year | Interest @ % |

Product Method

In this method, individual drawings are multiplied by the months remaining in the year and interest for one month (if period taken is in months) or for one day (if period is taken in days) is calculated on the total of such products. Following table is used:

| Date of Drawings | Amount of Drawings | Number of months remaining in the year | Product ( D = B x C) |

Case 3: When dates of withdrawal are not specified

In this case, total amount withdrawn is given but the date of withdrawals are not specified. In such case, it is assumed that the amount was withdrawn evenly throughout the year. Interest on total drawings is calculated for 6 months.

Case 4: When the rate of interest is given without the suffix ‘per annum’

In this case, interest will be charged without considering the time or date of drawings (i.e. without any reference to time period). In other words, interest will be charged for 12 months.

Read more from Fundamentals of Partnership

Profit and Loss Appropriation Account

Salary or commission paid to a partner

Rent paid to partner and Interest on loan