This topic is a part of the UNIT Fundamentals of Partnership Class 12 according to the CBSE curriculum.

According to Section 4 of the Indian Partnership Act, 1932 “Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all”.

The persons who have entered into a partnership with one another are individually called partners and partners collectively are known as firm. The name under which the business is carried, is called firm’s name.

So without any further ado lets dive into the introduction to partnership firms.

Table of Contents

Nature of Partnership Firm

Partnership is a separate business entity from accounting point of view, but from a legal point of view, partnership firm is not a separate legal entity from its partners, i.e. partners and business are not separate from one another.

Essential Features of Partnership

1. Two or More Persons: Partnership is an association of two or more persons and all such persons must be competent to contract.

- As per Section 464 of the Companies Act, 2013, maximum number of partners are prescribed as 100.

- However, as per rule 10 of Companies (Miscellaneous) Rules, 2014, maximum number of partners of a firm cannot exceed 50 persons.

2. Agreement: Partnership firms come into existence by an agreement between two or more persons, either written or oral.

3. Lawful Business: Agreement should be for the purpose of carrying on a business which must be legal.

4. Mutual Agency: The business of the partnership can be carried on by all or by any one of them, acting for all. Partners are agents as well as the principals of the firm.

5. Sharing of Profits: The agreement between the partners must be to share profits of a business. However, it is not essential that the losses are also shared by all partners.

6. Liability of Partnership: Each partner is liable individually and collectively with all other partners to the third party for all the acts of the firm, while he is a partner. Also, liability of a partner is unlimited. It implies that his private assets can also be used for paying off the firm’s debts.

Meaning of Partnership Deed

Partnership comes into existence as a result of agreement among the partners. The document containing the terms and conditions of the agreement in writing among partners is called the partnership deed,

It generally contains the details about all the aspects affecting the relationship between the partners.

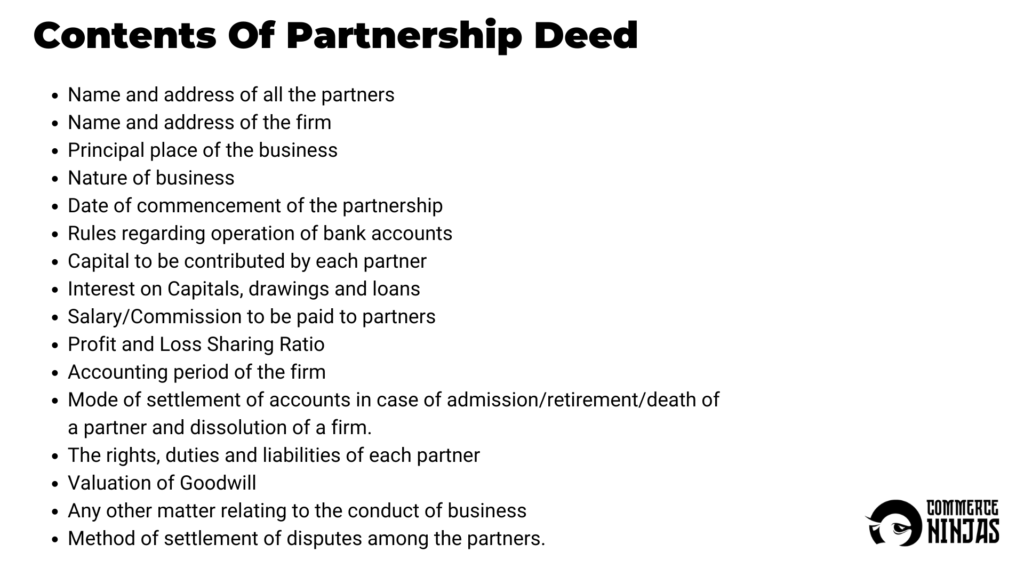

Contents of Partnership Deed

Importance of Partnership Deed

Partnership deed and its registration is not compulsory but it is always better to have the agreement in writing for the following reasons.

- It helps in settling any dispute or doubt with regard to the terms of partnership

- It serves as an evidence in the court of the law

- It regulates the rights, duties and liabilities of each partner

Provisions of the Indian Partnership Act, 1932 in the Absence of Partnership Deed

In the absence of partnership deed the relevant provisions of the Indian Partnership Act, 1932 are as follows:

- Profits and losses are to be shared equally irrespective of the type of partner (active or sleeping) or the amount of capital contributed by them

- No interest is to be allowed on capital

- No interest is to be charged on drawings made by the partners

- Partners are not entitled to any salary, commission or any remuneration

- Interest @ 6% per annum is to be allowed on loans and advances.

Apart from the above, the Indian Partnership Act specifies that subject to contract between the partners

- If a partner derives any profit for himself/herself from any transaction of the firm or from the use of the property or business connection of the firm or the firm name, he/she shall account for the profit and pay it to firm.

- If a partner carries on any business of the same nature and in competition with the firm, he/she shall account for and pay to the firm, all profits made by him/her in that business.

Read more from Fundamentals of Partnership

Profit and Loss Appropriation Account

Salary or commission paid to a partner

Rent paid to partner and Interest on loan